The Bitcoin Standard Notes

The Bitcoin Standard Notes#

Should you come out of reading this book thinking that the bitcoin currency is something worth owning, your first investment should not be in buying bitcoins, but in time spent understanding how to buy, store, and own bitcoins securely. It is the inherent nature of Bitcoin that such knowledge cannot be delegated or outsourced.

There is no alternative to personal responsibility

1. Money#

Barter. Trading goods for goods - with no money - is hard. A coincedence of wants also needs to occur, you need to want to buy and the seller needs to want to sell.

It stifles the advancement of human society - in my opinion.

Things making direct exchange rare:

- co-incedence of scale - breaking up of things that cannot be broken up

- co-incedence in timeframes - perishable vs durable. Harder to accumulate many perishables to buy something durable.

- co-indcedence of location - immovable goods (houses)

The way around this is indirect exchange. You exchange your good for something someone else wants, then buy the good you want with this something else. This is a medium of exchange.

A good that naturally assumes the role of a widely accepted medium of exchange is called money.

Being a medium of exchange is the quentessential function of money - a good not meant for consumption nor employed in the production of goods (capital / investment). Primarily for the exchange of other goods.

Investment is different from money:

- Offers a return

- Involves a risk of failure

- Less liquid than money

Holding investments can never entirely replace money

Human life involves uncertainty and it is wisdom in many cultures to save a portion in liquid money. The price of holding is the forgone consumption fromspending or forgone returns that could have been made from investing.

Carl Megner termed it Salability: the ease with which a good can be sold on the market whenever its holder desires - with the least loss in its price.

In human history gold and silver has served as money, but other things as well: copper, sea shells, salt, cattle, government paper, alcohol and cigarettes.

There is no right and wrong money. Just consequences of your choice.

salability is determined with scale, timeframes and location in mind.

Sold in any quantity the seller desires, ease of transportation and salability across time - holding value into the future. The last point is the most important.

Money is a store of value - the second function of money.

It should be immune to deterioration: rotting, corroding.

Supply of the good must also not increase too drastically.

Hard money vs easy money.

The supply of a good is determined by:

- stock - existing supply

- flow - amount created each timeperiod

The ratio between stock and flow determines money’s hardness.

High stock to flow ratio: even a large increase in production due to demand will not dramatically depress the price. Low stock to flow ratio: produces can create lots and depress the price - devaluing the good.

The easy money trap - anything that is used as a store of value will have it’s supply increase. The corollary to that is anythingused as money with have a natural of artificial restrictor of flow.

It has to be costly to produce.

When modern technology made the importation and catching of seashells easy, societies that used them switched to metal or paper money, and when a government increases its currency’s supply, its citizens shift to holding foreign currencies, gold, or other more reliable monetary assets

People that use hard money…benefit the most.

There is no need for government to impose the hardest money on society; society will have uncovered it long before it concocted its government

Those who are able to save their wealth in a good store of value are likely to plan for the future more than those who have bad stores of value.

Acceptability by others - The more people accept a monetary medium, the more liquid it is, and the more likely it is to be bought and sold without too much loss.

The gains from joining a network grow exponentially the larger the size of the network

- Facebook and a handful of social media networks dominate the market

- Any device that sends emails has to utilize the IMAP/POP3 protocol for receiving email, and the SMTP protocol for sending it. Many other protocols were invented, and they could be used perfectly well, but almost nobody uses them because to do so would preclude a user from interacting with almost everyone who uses email today, because they are on IMAP/POP3 and SMTP.

Prices expressed in terms of the medium of exchange == unit of account

Only with a uniform medium of exchange acting as a unit of account does complex economic calculation become possible

2. Primitive Moneys#

Read up on Rai stones

A one‐time collapse in the value of a monetary medium is tragic, but at least it is over quickly and its holders can begin trading, saving, and calculating with a new one.

But a slow drain of its monetary value over time will slowly transfer the wealth of its holders to those who can produce the medium at a low cost

the word salary is derived from sal, the Latin word for salt.

a money that is easy to produce is no money at all

3. Monetary Metals#

Iron and copper, because of their relatively high abundance and their susceptibility to corrosion, could be produced in increasing quantities.

Rarer metals such as silver and gold, on the other hand, were more durable and less likely to corrode or ruin, making them more salable across time and useful as a store of value into the future.

Gold, silver and copper coins were used since Greek king Croesus 2500 years agotothe early 20th century.

Coins allowed for the creation of large markets, increasing the scope of specialization and trade worldwide

2 issues:

- supply and demand of metals

- Government and counterfeiters could reduce the metal content in the coin

Individuals could transact with paper money and checks backed by gold in the treasuries of their banks and central banks.

The gold standard allowed for unprecedented global capital accumulation and trade by uniting the majority of the planet’s economy on one sound market‐based choice of money.

Its tragic flaw, however, was that by centralizing the gold in the vaults of banks, and later central banks, it made it possible for banks and governments to increase the supply of money beyond the quantity of gold they held, devaluing the money and transferring part of its value from the money’s legitimate holders to the governments and banks.

Any time a person chooses a good as a store of value, she is effectively increasing the demand for it beyond the regular market demand, which will cause its price to rise.

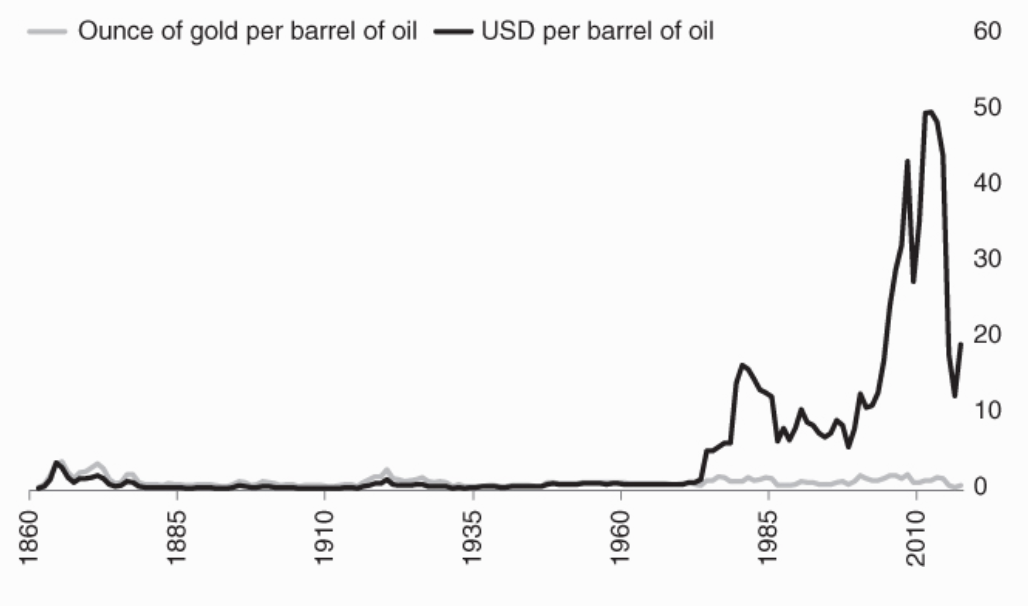

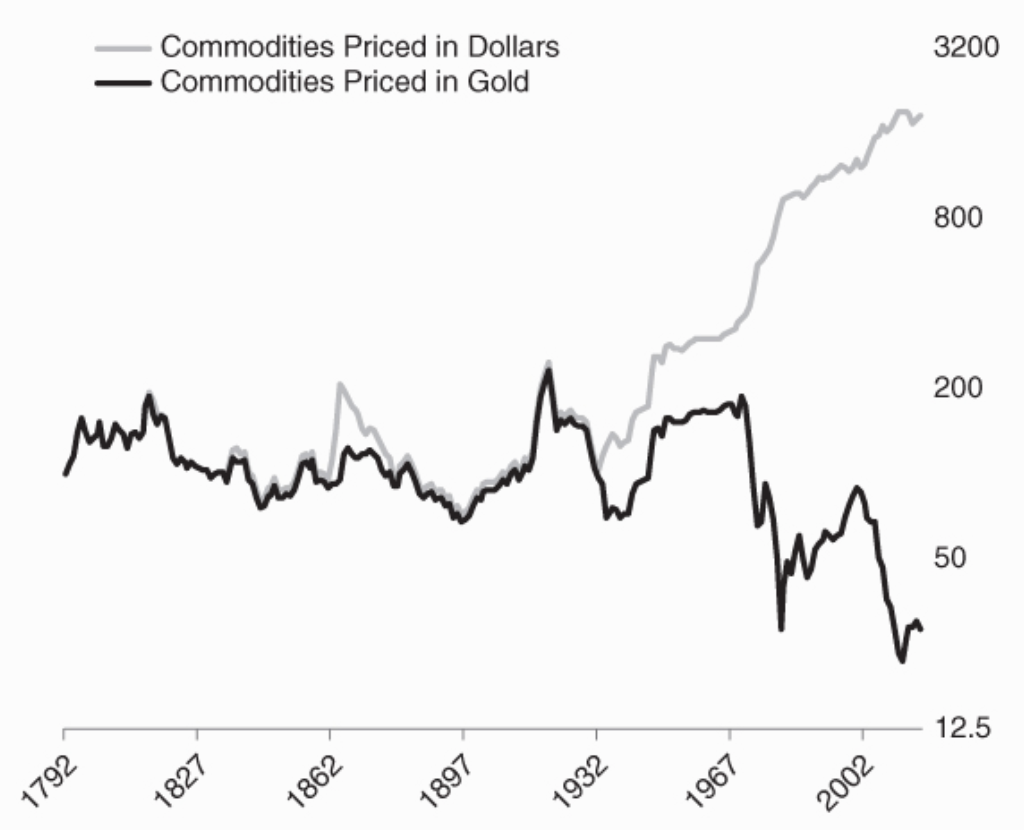

There is a reason why copper, zinc, nickel, brass, or oil is not used as a store of wealth. The supply can increase because these elements are abundant.

The net effect of this entire episode is the transfer of the wealth of the misguided savers to the producers of the commodity they purchased.

The anatomy of a bubble.

Producers must be naturally constrained from increasing supply.

2 characteristics that make gold immune from this devaluation:

- It is so stable it is impossible to destroy

- Gold is impossible to synthesize

It can only be extracted from unrefined ore - that is very rare.

The existing stockpile of gold is orders of magnitude greater than gold mined in a year. Over the past 7 decades the increase has been 1.5% never over 2%.

Only silver comes close to gold in this regard, with an annual supply growth rate historically around 5–10%, rising to around 20% in the modern day

- Silver does corrode

- silver is less rare than gold and easier to refine

Silves monetary role was removed when the gold standard allowed for backing of gold in any denomination for payments.

Silver became an industiral metal.

Second place in monetary terms is equivlanet to nothing.

The Hunt brothers tried buying and monetising Silv§er in 1970 but silver producers and holders and silver holders would sell it into the market.

Know about the stock-to-flow ratio

Central banks own 1/6 of above ground gold. 33000 tons. There is 198000 tons total.

The biggest increase in annual production of gold was 15% in 1923 - an increase in stockpiles of only 1.5%. The biggest global increase in stockpiles was 2.6% in 1940.

Julius Ceasar, the last dictator of the Roman republic, created the aureus coin - containing 8 grams of gold. It was widely accepted and economic stability occured for 75 years.

Even during Caesar’s assassination and transformation from a republic into an empire by Augustus. Continuing until emperor Nero started clipping, melting old coins and creating new ones with less gold content.

During the plundering of prosperous lands even peasants moved to Rome to enjoy a better life for free. Nothing lasts forever though and soon no prosperous lands were left to take conquer. The growing military, lavish lifestyles and unproductive citzens required some new source of financing. Nero who ruled 54 AD to 68 AD - decided to devalue the currency - to reduce the real wage, reduce the burden of government in subsidising staples and increase money for government expenditure. The same solution Keynes had after WW1.

The Aureus reduced from 8g to 7.2g. Setting in motion the debasement.

Cycle:

- popular anger

- price controls

- coin debasement

- price rises

Under Caracalla 211AD, Aureus moved to 6.5g. Under Diocletian it reduced to 5.5g. Before he introduced a replacement coin the solidus at 4.5g.

Misguided attempts to hide price inflation by instituiting price controls - making it unprofitable for producers to engage in production. Economic production came to a standstill.

Coin clipping -> increased money supply -> reducing real value -> continued overspending -> inflation

It should be of interest to modern Keynesian economists, as well as to the present generation of investors, that although the emperors of Rome frantically tried to “manage” their economies, they only succeeded in making matters worse. Price and wage controls and legal tender laws were passed, but it was like trying to hold back the tides. Rioting, corruption, lawlessness and a mindless mania for speculation and gambling engulfed the empire like a plague. With money so unreliable and debased, speculation in commodities became far more attractive than producing them. - Ferdinand Lips

As taxes increased and inflation made price controls unworkable, the urbanites of the cities started fleeing to empty plots of land where they could at least have a chance of living in self‐sufficiency, where their lack of income spared them having to pay taxes

Constantine the Great took over the reigns of the empire. The first Christian emperor who maintained the solidus at 4.5g - and minted it in large quanitites in 312AD. Moved east and established Constantinople birthing the east roman empire. Rome finally collapsed in 476 AD.The solidus became the longest serving sound money in human history.

In 1042- 1055, Constantinpole started devaluing the solidus. The solidus first minted in 301 AD turned into the bezant and then into the Isalmic Dinar - continues to circulate to this day.

History shows that a sound monetary standard is a necessary prerequisite for human flourishing, without which society stands on the precipice of barbarism and destruction

The fluctuating rate of exchange between gold and silver created trade and calculation problems

The invention of the telegraph in 1837 led to the increased use of bills and checks - instead of physical money. Paper fully redeemable by precious metals.

Some nations chose gold other chose silver, a fateful decision.

Britain was the first to adopt a modern gold standard in 1717, under the direction of physicist Isaac Newton, who was the warden of the Royal Mint.

Silvers role was crushed. India finally switched from silver to gold in 1898, while China and Hong Kong were the last economies in the world to abandon the silver standard in 1935.

Silver has been arguably demonetised.

A lesson to learn - your refusal of bitcoin does not you don’t have to deal with it. The consequences of others holding money that is harder than yours…

Goldin centralised banks gained salability across time, scales and location. However it lost its role as cash money.

Its centralisation killed the individual sovereignty over money and its resistance to government centralized control.

Control by a sovereign is the focus of Mises, Hayek, Rothbard and Salerno. Menger focused on salability.

1871, end of the France-prussian war, countries adopted gold and now were just concerned about the exchange based on the weight of gold present in the coin.

The British pound was defined as 7.3 grams of gold, while the French franc was 0.29 grams of gold and the Deutschmark 0.36 grams, meaning the exchange rate between them was necessarily fixed at 26.28 French francs and 24.02 Deutschmark per pound.

Each countries money supply was not a concern. The coin was worth its gold weight.

The soundness of money was reflected in free trade across the world and the increased savings rate - allowing for capital accumulation and technological improvements

Some of the most important technological, medical, economic, and artistic human achievements were invented during the era of the gold standard - la belle époque - the beautiful era

Not only were the economies of the west far freer back then, the societies themselves were far freer. Governments had very few bureaucracies focused on micromanaging the lives of citizens

The gold standard was vulberable though

- governments and banks were always creating media of exchange beyond the quantity of gold in their reserves.

- Many countries used not just gold in their reserves, but also currencies of other countries.

A run on gold was always possible.

central banks holding the gold could and did create money unbacked by physical gold and use it for settlement

The network of settlement became valuable enough that its owners’ credit was effectively monetized. As the ability to run a bank started to imply money creation, governments naturally gravitated to taking over the banking sector through central banking

You had to trust a third party not to abuse the gold standard…

But the most fanatical attacks against gold are made by those intent upon credit expansion. With them credit expansion is the panacea for all economic ills. - Mises

The gold standard’s acceptance requires the acknowledgement of the truth that one cannot make all people richer by printing money

Central banks still hold lots of Gold. Even in a world of government money, governments have not been able to decree gold’s monetary role away, as their actions speak louder than their words.

Samuelsons theory of revealed preference - it is not what people say but what they do.

4. Government Money#

World War I saw the end of freedom of choice of money by the market.

The common name for government money is fiat money - from the latin word for decree, order or authorise.

- There is a big difference between government money redeemable in gold and irredeemable government money

- No fiat has come into circulation purely by government fiat - it came into existance as redeemable gold and silver

Under a gold standard - money is gold. Government has no control over the supply of gold.

Credit - loans - for productive purposes are a great thing.

No pure fiat exists without some form of backing either gold or another currency

It is only by holding gold that governments could get their money to be accepted at all

World War I, frivolously started…created a global war becuase it was monetary. Most countries stopped gold convertability…effectively going off the gold standard.

Governments were no longer limited to the gold in their vaults. They could now keep printing money and finance the continuation of the war.

Previously gold was in the hands of the people.

people’s accumulated wealth expropriated through inflation

The Swiss Franc stayed on the gold stand where other countries currencies’ that participanted lost a lot of value. The war was financed by inflation.

All countries lost but Austria and Germany lost the most.

Now each country determined their own money’s supply and had to agree an exchange rate. Germany suffered hyperinflation and tried to pay reparations using inflation.

1922 Treaty of Genoa saw US dollar and Pound sterling be considered reserve currencies like gold.

Problems faced by the American economy in the 1930s were inextricably linked to the fixing of wages and prices. Wages were set too high, resulting in a very high unemployment rate, reaching 25% at certain points, while price controls had created shortages and surpluses of various goods. Some agricultural products were even burned in order to maintain their high prices, leading to the insane situation where people were going hungry, desperate for work, while producers couldn’t hire them as they couldn’t afford their wages, and the producers who could produce some crops had to burn some of them to keep the price high

President Roosevelt issued an executive order banning the private ownership of gold, forcing Americans to sell their gold to the U.S. Treasury at a rate of $20.67 per ounce. With the population deprived of sound money, and forced to deal with dollars, Roosevelt then revalued the dollar on the international market from $20.67 per ounce to $35 per ounce, a 41% devaluation of the dollar in real terms (gold)

John Keynes…never studied economics professionally. He basically just told these all-knowing governments what they wanted to hear.

The solution he sought was aggregate spending - the free market would not be the answer. The remedy is the debauching of the currency and the increase of government spending. Saving reduces spending and because spending is all that matters, government must do all it can to deter its citizens from saving.

Today government‐approved economics curricula still blame the gold standard for the Great Depression. The same gold standard which produced more than four decades of virtually uninterrupted global growth and prosperity between 1870 and 1914 suddenly stopped working in the 1930s because it wouldn’t allow governments to expand their money supply to fight the depression, whose causes these economists cannot explain beyond meaningless Keynesian allusions to animal spirits”

Keynesians fallacies also said all spending is spending. So huge amounts were spend on military - doesn’t matter how many were killed. More demand and less unemployment.

After WW2 the US governemnt cut spending by 75% (between 1944 and 1948) and flying in the face of Keynes, the economy boomed.

Bretton Woods - suggested by Harry Dexter White (US representative and communist) - was to use US dollar as the global reserve currency fixed exchange to other currencies and convertable to gold. The US would take gold from other central banks. US citizens could not convert to gold, nor could other countries. Only other countries Governments could.

Eventually the inflationism caused a rise in the price of gold. Creating the London gold pool for central banks to drop some supply into the market. Some countries even tried to repatriate their gold - Charles de Gaulle.

On 15 August 1971, Richard Nixon announced the end of dollar convertability to gold. The fixed exchange rates the IMF dealt with were let loose - now determined by goods and capital movement.

Nixon completed the step of moving from a gold standard to a government standard…started in WW1.

Inefficiencies arose: The seller does not want the currency held by the buyer, and so the buyer must purchase another currency first, and incur conversion costs.

The average growth of money supply is 32.16% per year per country

Hyperinflation is a form of economic disaster unique to government money

Only political constraints provide hardness, and there are no physical, economic, or natural constraints on how much money government can produce.

In 2003, when the United States invaded Iraq, aerial bombardment destroyed the Iraqi central bank and with it the capability of the Iraqi government to print new Iraqi dinars. This led to the dinar drastically appreciating overnight as Iraqis became more confident in the currency given that no central bank could print it anymore.

Why is government money the prime money of our time:

- government force taxes be paid in it - ensuring people are likely to accept it

- bank regulation ensure banks can only open accounts and trade in government money

- legal tender laws prevent trade in other types of money

- all government money is still backed by gold reserves - or currencies backed by gold reserves

Central banks have 33000 tons of gold in their vaults

Central banks’ large reserves of gold can be used as an emergency supply to sell or lease on the gold market to prevent the price of gold from rising during periods of increased demand, to protect the monopoly role of government money. As Alan Greenspan once explained: “Central banks stand ready to lease gold in increasing quantities should the price rise.”

Salability according to the will of its holder and not a third party.

For those who worship government power and take joy in totalitarian control, such as the many totalitarian and mass‐murdering regimes of the twentieth century, this monetary arrangement was a godsend

5. Money and Time Preference#

Human beings’ lower time preference allows us to curb our instinctive and animalistic impulses, think of what is better for our future, and act rationally rather than impulsively. Instead of spending all our time producing goods for immediate consumption, we can choose to spend time engaged in production of goods that will take longer to complete, if they are superior goods.

The fisherman who builds a fishing rod is able to catch more fish per hour than the fisherman hunting with his bare hands. But the only way to build the fishing rod is to dedicate an initial amount of time to work that does not produce edible fish, but instead produces a fishing rod. This is an uncertain process, for the fishing rod might not work and the fisherman will have wasted his time to no avail. Not only does investment require delaying gratification, it also always carries with it a risk of failure, which means the investment will only be undertaken with an expectation of a reward.

Lower time preference means you are willing to wait longer.

Monetary Inflation#

A theoretically ideal money would be one whose supply is fixed, meaning nobody could produce more of it. The only noncriminal way to acquire money in such a society would be to produce something of value to others and exchange it with them for money.

Gold supply is gauranteed by the rules of physics and chemistry

The reality of monetary competition constantly has disadvantaged individuals and societies that invest their savings in metals other than gold while rewarding those who invest their savings in gold.

The folly of Keynes condemning gold as money because its mining is wasteful is that it is the least wasteful of all potential metals to use as money

One of the fundamental laws of economics is the law of diminishing marginal utility, which means that acquiring more of any good reduces the marginal utility of each extra unit.

Money is the good with the least diminishing marginal utility

Investment is a reward for taking risk, but sound money, having the least risk, offers no reward.

Relative stability of value is not just important to preserve the purchasing power of holders’ savings, it is arguably more important for preserving the integrity of the monetary unit as a unit of account

Savings and Capital Accumulation#

One of the key problems caused by a currency whose value is diminishing is that it negatively incentivizes saving for the future

With unsound money, on the other hand, only returns that are higher than the rate of depreciation of the currency will be positive in real terms, creating incentives for high‐return but high‐risk investment and spending

The track record of the 46‐year experiment with unsound money bears out this conclusion. Savings rates have been declining across the developed countries, dropping to very low levels, while personal, municipal, and national debts have increased to levels which would have seemed unimaginable in the past.

The average savings rate of the 7 largest economies has dropped from 12.66% in 1970 to 3.39% in 2015.

Emotional blackmail on national indebtedness: “we would be short‐changing ourselves if we didn’t borrow to invest for our future”

There is nothing new here - same as roman emperors - instead it is using government issued paper and not metallic coins.

It is an ironic sign of the depth of modern‐day economic ignorance fomented by Keynesian economics that capitalism—an economic system based on capital accumulation from saving—is blamed for unleashing conspicuous consumption—the exact opposite of capital accumulation

Capitalism is what happens when people drop their time preference, defer immediate gratification, and invest in the future

Keynes viewed the level of spending at any point in time as being the most important determinant of the state of the economy because, having studied no economics, he had no understanding of capital theory and how employment does not only have to be in final goods, but can also be in the production of capital goods which will only produce final goods in the future. And having lived off of his family’s considerable fortune without having to work real jobs, Keynes had no appreciation of saving or capital accumulation and their essential role in economic growth.

Debt is the opposite of saving

If saving creates the possibility of capital accumulation and civilizational advance, debt is what can reverse it, through the reduction in capital stocks across generations, reduced productivity, and a decline in living standards

…Making indebtedness the new method for funding major expenses. Whereas 100 years ago most people would pay for their house, education, or marriage from their own labor or accumulated savings, such a notion seems ridiculous to people today.

With nationalized money, that became an increasingly harder choice to make, as central governmental control of money supply inevitably destroys incentives to save while increasing the incentive to borrow

John Maynard Keynes was childless and gay…no wonder adoption of his policies made without study of economic forefathers…would make future generations worse off.

Innovations: Zero to One (vs) One to Zero#

In the era of unsound money, no artist has the low time preference to work as hard or as long as Michelangelo or Bach to learn their craft properly or spend any significant amount of time perfecting it

A stroll through a modern art gallery shows artistic works whose production requires no more effort or talent than can be mustered by a bored 6‐year‐old

6. Capitalism and Information Systems#

The rise in the price itself contains all the relevant information they need

Immediately, all the firms demanding copper now have an incentive to demand a smaller quantity of it, delay purchases that weren’t immediately necessary, and find substitutes. On the other hand, the rising price gives all firms that produce copper anywhere around the world an incentive to produce more of it, to capitalize on the price rise.

Prices are the only mechanism that allows trade and specialization to occur in a market economy.

Capital Market Socialism#

Socialism not only fails because of the lack of incentive (arguably they solved the problem shown by the resultant 100 million deaths).

The fatal flaw of socialism that Mises exposed was that without a price mechanism emerging on a free market, socialism would fail at economic calculation, most crucially in the allocation of capital goods

Decisions are no longer sound.

If government owns steel producers, users of steel and car and train factories…there is no way of knowing the optimal allocation.

Scarcity is the starting point of all economics.

A central planner is in the dark about everything. Way too many variables. You can’t calculate and decide on technology that does not exist.

Those who confuse entrepreneurship and management close their eyes to the economic problem…. The capitalist system is not a managerial system; it is an entrepreneurial system - Ludwig von Mises

Eugen von Böhm‐Bawerk, even argued that the interest rate in a nation reflected its cultural level: the higher a people’s intelligence and moral strength, the more they save and the lower the rate of interest

These days central banks determine the interest rate.

A fundamental fact to understand about the modern financial system is that banks create money whenever they engage in lending

By giving the money to the borrower while keeping it available to the depositor, the bank effectively creates new money and that results in an increase in the money supply

Business Cycles and Fianncial Crises#

In the capital market, the opportunity cost of capital is forgone consumption, and the opportunity cost of consumption is forgone capital investment

Central bank manages money supply using the interest rate. It lowers the interest rate and increases money supply to spur economic growth and consumption. Businesses take on more debt than savers decide to put away.

As more and more producers are bidding for fewer capital goods and resources than they expect there to be, the natural outcome is a rise in the price of the capital goods during the production process.

Economic logic clearly shows how recessions are the inevitable outcome of interest rate manipulation in the same way shortages are the inevitable outcome of price ceilings

See Switzerland staying neutral with the gold standard until 1992 when it joined the IMF. Having unemployment never above 1%. The IMF rules prevent tying a currency to gold - so it began to experience the Keynesian pleasures - unemployment rising to 5%.

Author goes all out on Milton Friedman and Schwartz for their Monetary tome that fails to mention the causes of the recessions and busts.

It is this increase of the dollar stock, beyond the stock of gold, which is the root cause of the Great Depression

The cause of waves of unemployment is not ‘capitalism’ but governments denying enterprise the right to produce good money. - Hayek

Sound basis for Trade#

Tarrifs and trade barriers hardly existed under the Aureus and Gold Standard

In the current era of monetary nationalism…trade is now of national importance - no longer something done by free individuals

- trade surplus - countries exports are larger than imports -> currency appreciates

- trade deficit - countires exports are less than imports -> currency devalues

Devaluing a currency is similar to changing the length of a meter on a daily basis by government. Engineers would not be happy.

The size of the foreign exchange market is $5.1 trillion per day in April 2016 according to the bank of international settlements - which is about $1860 trillion poer year. The world bank estimates GDP of all the worlds countries combined at $75 trillion.

So the foreign exchange market is 25 times larger than economic production.

Foreign exchange is not productive process - why it is not counted as GDP.

In 1900 an entreprenuer could make plans with no thought of exchange rate fluctuations, a century later things have gotten harder and more complex.

Unfortunately, however, the people in charge of the current monetary system have a vested interest in it continuing, and have thus preferred to try to find ways to manage it, and to find ever‐more‐creative ways of vilifying and dismissing the gold standard. FIrst rule of the con, never give up the con

The combination of Keynesian ideology and floating exhange rates cause the currency wars. Keynesians say increasing exports increases GDP (tHe holy grail of economic well being) - it follows in the mind of Keynesians that anything increasing exports is good. Making exports cheaper is good - so devaluing your currency is good - leading to increased exports and less unemployment.

All this does is create a once off discount to foreigners, where locals have to pay the higher price - impoverishing them. It also makes all assets cheaper for foreigners - alloing them to purchase land and resources at a cheaper price.

In Keynesian ideology, foreigners are subsidised to take.

The key is to make exports that the rest of the world wanted with a competitive advantage - Japan, Germany and Switzerland did this. This appreciates the value of the currency - increasing the wealth of the population.

None of this would be necessary if only the world were to be based on a sound global monetary system that serves as a global unit of account and measure of value, allowing producers and consumers worldwide to have an accurate assessment of their costs and revenues, separating economic profitability from government policy

7. Sound Money and Individual Freedom#

For those of us alive today, raised on the propaganda of the omnipotent governments of the twentieth century, it is often hard to imagine a world in which individual freedom and responsibility supersede government authority. Yet such was the state of the world during the periods of greatest human progress and freedom

There are three ways of stimulating aggregate spending: increasing the money supply, increasing government spending, or reducing taxes. Reducing taxes is generally frowned upon by Keynesians. It is viewed as the least effective method, because people will not spend all the taxes they don’t have to pay—some of that money will be saved, and Keynes absolutely detested saving. Saving would reduce spending, and reducing spending would be the worst thing imaginable for an economy seeking recovery

The sum total of the contribution of both these schools (Keynesian’s and Monetarist’s) of thought is the consensus taught in undergraduate macroeconomics courses across the world: that the central bank should be in the business of expanding the money supply at a controlled pace, to encourage people to spend more and thus keep the unemployment level sufficiently low.

The creed of Keynes, which is universally popular today, is the creed of consumption and spending to satisfy immediate wants

By constantly expanding the money supply, central banks’ monetary policy makes saving and investment less attractive and thus it encourages people to save and invest less while consuming more

It is short term myopic thinking. A high-time preference.

The autstrian school focuses on pragmatic economics.

Austrian theory:

- Money emerges from the most marketable and salable of goods

- An assets that holds its value is more preferable to one that does not

- absense of the control by government is a necessity for sound money (Mises)

The services money renders are conditioned by the height of its purchasing power. Nobody wants to have in his cash holding a definite number of pieces of money or a definite weight of money; he wants to keep a cash holding of a definite amount of purchasing power - Ludwig von Mises

A world of constant money supply would be one similar to that of much of the eighteenth and nineteenth centuries, marked by the successful flowering of the Industrial Revolution with increased capital investment increasing the supply of goods and with falling prices for those goods as well as falling costs of production. - Murray Rothbard

The culture of conspicuous consumption, of shopping as therapy, of always needing to replace cheap plastic crap with newer, flashier cheap plastic crap will not have a place in a society with a money which appreciates in value over time.

A currency that depreciates in value, on the other hand, leaves citizens constantly searching for returns to beat inflation, returns that must come with a risk, and so leads to an increase in investment in risky projects and an increased risk tolerance among investors, leading to increased losses.

An economy with appreciating currency would only invest in projects that offer a real return over the rate of appreciation of money - meaning only projects likely to increase capital stock will be taken on.

By contrast, an economy with a depreciating currency incentivizes individuals to invest in projects that offer positive returns in terms of the depreciating currency, but negative real returns

These projects beat inflation but do not produce a real return - rational for investors as they decrease in value slowed than the depreciating currency. Malinvestments…termed by Ludwig von Mises.

That is why Austrian scool of economics favour gold.

Unsound Money and Perpetual War#

- Unsound money is a barrier of trade between countries - causing conflict between countries

- Government creating money - allows it to continue fighting perpetually by devaluaing its own currency - without it, it would be forced to use only taxes

- Individuals with sound money - develop a low time preference allowing them more time to cooperate

The modern individual living in a free‐trading society is able to work for a few hours a day in a highly specialized job, and with the money she makes she is able to purchase the goods she wants from whichever producers in the entire planet make them with the lowest cost and best quality. To fully appreciate the gains from trade that accrue to you, just imagine trying to live your life in self‐sufficiency. Basic survival would become a very hard task for any of us, as our time is spent inefficiently and fruitlessly attempting to provide the very basics of survival to ourselves.

There is no winner in violent conduct.

That explains why the 20th century was the deadliest in human history.

Limited vs Omnipotent Government#

Liberalism and liberality - words that have been bastardised.

Socially, economically, and politically, the role of government was recast as the wish‐granting genie, and the population merely had to vote for what it wanted to have it fulfilled.

In a society of sound money, government is reliant on the consent of its population to finance its operations

A government seeking funding for legitimate national defense and infrastructure projects would have little trouble imposing taxes on, and selling bonds to, the population that saw the benefits before their eyes. But a government which raises taxes to fund a monarch’s lavish lifestyle will engender mass resentment among his population, endangering the legitimacy of his rule and making it ever more precarious.

Consumption must come after production

Modern voters are unlikely to favor the candidates who are upfront about the costs and benefits of their schemes; they are far more likely to go with the scoundrels who promise a free lunch and blame the bill on their predecessors or some nefarious conspiracy. Democracy thus becomes a mass delusion of people attempting to override the rules of economics by voting themselves a free lunch and being manipulated into violent tantrums against scapegoats whenever the bill for the free lunch arrives via inflation and economic recessions.

Sound money makes the form of government a question with limited consequences

The Bezzle#

There is therefore no societal benefit from any activity which increases the supply of money.

Friedman and Keynes wanted to stop gold mining to reduce costs. However, they dd not factor in the wasted resources that now will go to chasing after government-issued money rather than economic production.

In a sound monetary system, any business that survives does so by offering value to society, by receiving a higher revenue for its products than the costs it incurs for its inputs.

Bezzle - companies that exist without producing anything of value to society. They just feed of low interest loans and cash from government.

Even after a government agencies reason for existance has been removed it will continue operating and finding more duties and responsibilties. Lebanon, for instance, continues to have a train authority decades after its trains were decommissioned and the tracks rusted into irrelevance.

International governmental organisations and academia have been removed from responsibility and consequences…

Paul Samuelson - who created the theory of revealed preference. A Nodel winner who said that ending WW2 would cause the biggest recession in history - wheras the biggest boom in US histiry occurred. His widely used textbook predicted in 1961 that the soviet economy would overtake the US between 1984 and 1997.

Even after the failure and collabse of Soviet Union, textbooks still waxed lyrical about its success in managing the economy.

Governments, universally, love Keynesian economics today for the same reason they loved it in the 1930s: it offers them the sophistry and justification for acquiring ever more power and money.

The debates of academia are almost entirely irrelevant to the real world, and its journals’ articles are almost never read…

As telecommunications have advanced, one would expect that more and more of the financial industry’s work can be automated and done mechanistically, leading to the industry shrinking in size over time. But in reality it continues to mushroom, not because of any fundamental demand, but because it is protected from losses by government and allowed to thrive.

Any industry in which people complain about their asshole boss is likely part of the bezzle, because bosses can only really afford to be assholes in the economic fake reality of the bezzle

The bezzle can appear seductive from outside, thanks to the generous regular paychecks and the lack of actual work involved, but if there’s one lesson economics teaches us, it is that there is no such a thing as a free lunch. Money being handed out to unproductive people will attract a lot of people who want to do these jobs, driving up the cost of doing these jobs in time and dignity. Hiring, firing, promotion, and punishment all happen at the discretion of layer upon layer of bureaucrats. No work is valuable to the firm, everyone is dispensable, and the only way anyone maintains a job is by proving valuable to the layer above him. A job in these firms is a full‐time game of office politics. Such jobs are only appealing to shallow materialistic people who enjoy having power over others, and years of being maltreated are endured for the paycheck and the hope of being able to inflict this maltreatment on others.

8. Digital Money#

Bitcoin has operated with practically no failure for the past 9 years

Payment methods before bitcoin:

- Cash payments - in person, immediate and final, require no trust as there is no third party. Main drawback is the 2 partys need to be physically present.

- Intermediated payments - require a trusted third party, cheques, credit cards, debit cards, money transfer services - paypal. Allows payments where both parties need not be present and without having to carry cash. The main drawback is the need to trust the third party, the cost and time for the payment to be cleared.

Third parties introduce risk and technical failure. They are also vulnerable to surveillance and bans by politicians. They also have the risk of fraud.

Satoshi Nakamoto’s motivation for Bitcoin was to create a “purely peer‐to‐peer form of electronic cash” that would not require trust in third parties for transactions and whose supply cannot be altered by any other party.

Nakamoto succeeded in achieving this through the utilization of a few important though not widely understood technologies: a distributed peer‐to‐peer network with no single point of failure, hashing, digital signatures, and proof‐of‐work

Whenever a member of the network transfers a sum to another member, all network members can verify the sender has a sufficient balance, and nodes compete to be the first to update the ledger with a new block of transactions every ten minutes. In order for a node to commit a block of transactions to the ledger, it has to expend processing power on solving complicated mathematical problems that are hard to solve but whose correct solution is easy to verify. This is the proof‐of‐work (PoW) system, and only with a correct solution can a block be committed and verified by all network members.

The quantity of bitcoins created is preprogrammed and cannot be altered no matter how much effort and energy is expended on proof‐of‐work. This is achieved through a process called difficulty adjustment, which is perhaps the most ingenious aspect of Bitcoin’s design. As more people choose to hold Bitcoin, this drives up the market value of Bitcoin and makes mining new coins more profitable, which drives more miners to expend more resources on solving proof‐of‐work problems. More miners means more processing power, which would result in the solutions to the proof‐of‐work being arrived at faster, thus increasing the rate of issuance of new bitcoins. But as the processing power rises, Bitcoin will raise the difficulty of the mathematical problems needed to unlock the mining rewards to ensure blocks will continue to take around ten minutes to be produced.

Bitcoin is built on 100% verification and 0% trust

To the extent that the digital coins exist, they are simply entries on a ledger, and a verified transaction changes the ownership of the coins on the ledger from the sender to the recipient.

What keeps Bitcoin nodes honest, individually, is that if they were dishonest, they would be discovered immediately, making dishonesty exactly as effective as doing nothing but involving a higher cost.

Bitcoin is the first example of a new form of life.

It lives and breathes on the internet.

It lives because it can pay people to keep it alive.

It lives because it performs a useful service that people will pay it to perform.

It lives because anyone, anywhere, can run a copy of its code.

It lives because all the running copies are constantly talking to each other.

It lives because if any one copy is corrupted it is discarded, quickly and without any fuss or muss.

It lives because it is radically transparent: anyone can see its code and see exactly what it does.

It can't be changed.

It can't be argued with.

It can't be tampered with.

It can't be corrupted.

It can't be stopped.

It can't even be interrupted.

If nuclear war destroyed half of our planet, it would continue to live, uncorrupted.

It would continue to offer its services.

It would continue to pay people to keep it alive.

The only way to shut it down is to kill every server that hosts it.

Which is hard, because a lot of servers host it, in a lot of countries, and a lot of people want to use it

Realistically, the only way to kill it is to make the service it offers so useless and obsolete that no one wants to use it.

So obsolete that no one wants to pay for it.

No one wants to host it.

Then it will have no money to pay anyone.

Then it will starve to death.

But as long as there are people who want to use it, it's very hard to kill, or corrupt, or stop, or interrupt.

- Ralph Merkle

Nakamoto was able to invent digital scarcity

While it is trivial to send a digital object from one location to another in a digital network, as is done with email, text messaging, or file downloads, it is more accurate to describe these processes as copying rather than sending, because the digital objects remain with the sender and can be reproduced infinitely

Bitcoin is also the first example of absolute scarcity, the only liquid commodity (digital or physical) with a set fixed quantity that cannot conceivably be increased

Supply, Value and Transactions#

Government would always want to monopolize money production and face too strong a temptation to engage in the increase of the money supply

Money supply growth in bitcoin is programmed and adopted by the network.

In the early stages the supply schedule was at risk of being changed. As time went on the supply rate dropped and the network gained reliability. The currency also gained credibility.

A block is added to the chain roughly every 10 minutes. The reward started at 50 btc per block (coinbase transaction).

Every 4 years or 210000 blocks - the reward halves.

- 28 November 2012 - 25 BTC per block

- 9 July 2016 - 12.5 BTC per block

- May 2020 - 6.25 BTC per block

It approached 21,000,000 in total supply.

New coins are only produced with new blocks and new blocks require the proof of work - there is a real cost of production of new bitcoin.

As the price rises - more nodes compete for the reward. Making hash rate higher and the problem more difficult. The cost to produce rises along with the market price.

Each bitcoin is divided into 100,000,000 satoshis

The smallest unit is: 0.00000001 BTC

The growth rate of every other asset (and of course fiat) will increase faster than bitcoin.

Whereas traditional currencies are continuously increasing in supply and decreasing in purchasing power, bitcoin has so far witnessed a large increase in real purchasing power despite a moderate, but decreasing and capped, increase in its supply.

The market demand for a bitcoin token comes from the fact that it is needed to operate the first (and so far, arguably only) functional and reliable digital cash system.

Ludwig von Mises’ Theory of Regression on the origins of money: a monetary good begins as a market good and is then used as a medium of exchange.

Bitcoin started as a collectable among crytographers.

When there is a spike in demand - miners cannot increase the supply schedule like copper miners can. No central bank can step in either - to flood the market - like gold.

The only way for the market to meet the growing demand is for the price to rise enough to incentivize the holders to sell some of their coins to the newcomers.

Without a number of people willing to hold the currency for a significant period of time, continued selling of the currency will keep its price down and prevent it from appreciating.

The expansionary monetary policies of modern fiat economies and economists have never won the market test of adoption freely, but have instead been imposed through government laws, as discussed earlier.

Annual transactions and daily average transactions is going up. With bitcoin blocks being limited to 1MB - 500,000 transactions a day is the upper limit.

As long as Bitcoin is growing, its token price will behave like that of a stock of a start‐up achieving very fast growth. Should Bitcoin’s growth stop and stabilize, it would stop attracting high‐risk investment flows, and become just a normal monetary asset expected to appreciate slightly every year.

9. What is Bitcoin Good For?#

Store of Value#

The absolute quantity of raw materials is too large for humans to comprehend. The more we search and dig the more resources we find. The only realistic limit is human time to produce the resource.

The only scarce resource is human time

We have never run out of a resource and the resource is cheaper today most likely. Proven reserves have also increased over time.

Rarer metals - are harder to find - requiring more time to get them and are therefore more expensive.

The environment hysteria - scaremongering.

The fundamental driver of human progress is technological advancement not raw material abundance.

Technology is non-excludable and non-rival, it can be copied by others to derive benefit and one person benefiting does not reduce the utility another derives.

The wheel for example.

Good inventions and ideas are rare. The more people that live the more technology and productive ideas. The more humans - the more tech and production - so more resources can be used and extracted. A larger population can be sustained.

The eternal dilemma humans face with their time concerns how to store the value they produce with their time through the future.

As monetary inflation proceeds, the large number of bubbles can be understood as speculative bets for ways to find a useful store of value.

Only gold has come close to solving this problem, thanks to its chemistry making it impossible for anyone to inflate its supply, and that resulted in one of the most glorious eras of human history.

For the first time, humanity has recourse to a commodity whose supply is strictly limited

Before bitcoin all forms of money were unlimited in quanity and therefore imperfect in their ability to store value across time.

Bitcoin’s immutable supply makes it the best medium to store value from limited human time.

Bitcoin is the cheapest way to buy the future - because bitcoin is gauranteed not to be debased.

Bitcoin’s stock‐to‐flow ratio will overtake that of gold, and by 2025

Around the year 2140 there will be no new supply of Bitcoin, and the stock‐to‐flow ratio becomes infinite, the first time any commodity or good has achieved this.

As the block subsidy declines, the resources dedicated to mining bitcoins will be mainly rewarded for processing the transactions and thus securing the network, rather than for the creation of new coins.

Strict scarcity

Bitcoin allows humans to transport value digitally without any dependence on the physical world, which allows large transfers of sums across the world to be completed in minutes.

The best savings technology ever invented?

Individual Sovereignty#

Anyone in the world has access to it.

No permissions needs to be asked for.

Bitcoin’s value is not reliant on anything in the physical worlk (except nodes and the internet)

It cannot be confiscated, destroyed or disabled

Escaping the financial clout of governments - tax by the threat of violence.

A book highlights this: the sovereign individual

New forms of organization will emerge from information technology, destroying the capacity of the state to force citizens to pay more for its services than they wish.

We can already see this process taking place thanks to the telecommunication revolution. Whereas the printing press allowed the poor of the world to access knowledge that was forbidden them and monopolized by the churches, it still had the limitation of producing physical books which could always be confiscated, banned, or burned.

Productive capital becomes more embodied in the individuals themselves, making the threat of violently appropriating it increasingly hollow, as individuals’ productivity becomes inextricably linked to their consent.

The historical version of sound money, gold, did not have these advantages. Gold’s physicality made it vulnerable to government control. That gold could not be moved around easily meant that payments using it had to be centralized in banks and central banks, making confiscation easy.

Bitcoin offers the modern individual the chance to opt out of the totalitarian, managerial, Keynesian, and socialist states. It is a simple technological fix to the modern pestilence of governments surviving by exploiting the productive individuals who happen to live on their soil.

Government will be forced to become a voluntary organisation - offering services and surviving by people choosing to pay for them.

Only a rulerless, purely libertarian world can fulfill the qualifications of natural rights and natural law, or, more important, can fulfill the conditions of a universal ethic for all mankind. - The ethics of Libery, Rothbard

Any aggression, whether carried out by government or individual, cannot have moral justification

Voluntary and peaceful.

International and Online Settlement#

As governments confiscated gold and issued their own money, it was no longer possible for global settlements between individuals and banks to be done with gold, and instead they were conducted with national currencies fluctuating in value, creating significant problems for international trade

Bitcoin. Bitcoin does not have to be stored on a computer; the private key to a person’s bitcoin hoard is a string of characters or a string of words the person remembers.

It is far easier to move around with a Bitcoin private key than with a hoard of gold, and far easier to send it across the world without having to risk it getting stolen or confiscated.

With bitcoin as a reserve currency - individuals could audit in real time the holdings of the intermediary.

The majority of transactions do not happen on chain - they are done on exchanges.

There are only a few currencies that are accepted for payment worldwide, namely the U.S. dollar, the euro, gold, and the IMF’s Special Drawing Rights

The high cost of these transactions lies primarily in the volatility of trading currencies and the problems of settlement between institutions in different countries, which necessitates the employment of several layers of intermediation.

My calcaultion of how much of your net worth should be in bitcoin:

(price of bitcoin($)/ 1000000) * percentage you understand and have verified the network, bitcoin-core, protocol and process

For me September 2021: 48000/1000000 * 0.9 = 0.0432

Bitcoin to be the reserve currency for banks.

Global Unit of Account#

Cross border economic activity is hampered by requiring to use the other countries money.

Monetary status is a spontaneously emergent product of human action, not a rational product of human design.

10. Bitcoin Questions#

Only by making accuracy based on CPU cycles expended by members, in other words, employing a proof‐of‐work system, can Bitcoin solve the double‐spending problem without a trusted third party.

PoW is the only method so far discovered for making the production of a digital good reliably expensive, allowing it to be a hard money.

PoW makes the cost of writing a block extremely high and the cost of verifying its validity extremely low, almost eliminating the incentive for anyone to try to create invalid transactions.

In January 2017, the processing power behind the Bitcoin network processing power behind the Bitcoin network is equivalent to that of 2 trillion consumer laptops. It is more than two million times larger than the processing power of the world’s largest supercomputer, and more than 200,000 times larger than the world’s top 500 supercomputers combined. By monetizing processing power directly, Bitcoin has become the largest single‐purpose computer network in the world.

Should an attacker succeed in altering the record, he would be highly unlikely to gain any economic benefit from it, as compromising the network would probably reduce the value of bitcoins to close to nothing.

Being an entirely voluntary system, Bitcoin can only operate if it is honest, as users can very easily leave it otherwise.

Immutability#

The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime. —Satoshi Nakamoto, 6/17/2010

It would be tempting here to say that node operators control Bitcoin, and that is true in an abstract collective manner. More realistically, node operators can only control their own nodes and decide for themselves which network rules to join and which transactions they deem valid or invalid.

Voluntary - human action.

For as long as any members stay on the old network, they would benefit from the infrastructure of the network as it exists, the mining equipment, the network effect, and name recognition.

The problem with forks - is for it to succeed you have to sell your coins on the old chain - and no one wants to do that.

Bitcoin holders are required for a big shift - no group has the power. A change to increase the block reward may help miners - but not holders (not not miners because holders are negatively impacted)

Coders can only propose changes - full node runners and users are free to choose which version they download and run.

Gavin Andresen and Mike Hearn were hired by a crypto consoritium and financial instituitions. They wanted to increase the block size on BitcoinXT. In a ney york times article Hearn sold his bitcoin when price was $350. Trying to raise the blocksize from 1MB to 8MB with Bitcoin clasic also fizzled out by 2016. Then bitcoin unlimited was announced in 2017 - the owner of the bitcoin.com domain name also tried to convince people to use it.

In August 2017, a group of programmers proped Bitcoin cash. It has a technical proplem - the forked chain has lower value coins so hashing power of bitcoin can quickly be switched to the forked coin and suffer an attack.

Antifragility#

Gaining from adversity and disorder.

Bitcoin endures even through the hostility and bad press.

In 2013, People thought the closing of silkroad would mean the end of bitcoin. In September 2017, China closed all chinese exchanges trading in bitcoin. It dropped by 40% but then rose to double in 2 months.

Can Bitcoin Scale?#

The 1MB block size forces 500,000 transactions per day? Payment processing will have to be centralised like Mastercard and Visa. Bitcoin max is 4 transactions per second - 350,000 per day.

To match a visa or mastercard - bitcoin would need to 800MB every 10 minutes. 42 terabytes per year. Not possible for the average consumer to run that full node.

In 2013, Visa operated a network of 376 servers, 277 switches, 85 routers, and 42 firewalls.

That is why transaction costs are rising and will continue to rise. The biggest scope for scaling bitcoin will happen off-chain.

Merchants and customers cannot wait 1 to 12 minutes to receive the first confirmation.

Saving in Bitcoin by its very nature will not require many transactions, and so a high transaction fee is worth paying for it.

And for transactions that cannot be carried out through the regular banking system, such as people trying to get their money out of a country suffering inflation and capital controls, Bitcoin’s high transaction fees will be a price well worth paying.

All that is happening is that the less important transactions are being moved off‐chain and the on‐chain transactions are growing in importance

Also transactions in bitcoin casinoes and exchanges are much higher and happen off chain - until withdrawal. Bitcoin is already being used as a reserve asset.

While many Bitcoin purists value the freedom accorded to them by being able to hold their own money and not rely on a financial institution to access it, the vast majority of people would not want this freedom and prefer to not have their money under their responsibility for fear of theft or abduction

In 2016 and 2017 the max number of transactions was being reached and bitcoin is acting more as a settlement network.

Is Bitcoin for Criminals?#

Bitcoins anonymity is the same as that of the internet. It depends how well you hide. It is hard to discard of a bitcoin address once used.

Bitcoin is a technology for money and money has been used by criminals at all times.

If an action has no victims, it is no crime, regardless of what some self‐important voters or bureaucrats would like to believe about their prerogative to legislate morality for others.

So one can expect that victimless crimes, such as online gambling and evading capital controls, would use Bitcoin, but murder and terrorism would more likely not.

It is not a tool to be feared, but one to be embraced as an integral part of a peaceful and prosperous future.

The best example of crime is ransomware - built around taking advantage of lax computer security. It has allowed the detection and exposure of security flaws - but not where the cost is the competitor gaining insider info. Initially hackers benefit from this - in the long run productive businesses do.

How to kill Bitcoin: A beginner’s guide#

Hacking#

Bitcoin’s hacking resistant proeprties:

- simplicity

- processing power

- distributed nodes

For most systems to run - certain computers are made impenetrable. Bitcoin takes the opposite approach, it does not secure any individual node - it expects each node to be a hostile attacker. Instead of trust - verification. The verification is based on proof of work - a brute force operation. Invulnerable to problems of access and credentials. Nodes have a low cost of detecting fraud - but a high cost to create it. The majority have a vested interest in bitcoin surviving.

The 51% Attack#

During a fork they can double spend. In pracitce very hard to use. The longer the recipient waits, the less likely the attacker to succeed. A successful 51% attack undermines the value of bitcoin.

They have a long term interest in the success of the network. Betcoin dice did get caught out on a double spend - because it was doing 0 confirmations. Always wait for at least 6 confirmations.

A government or private entity could try it - not for profit. If a government made the big investment in mining equipment - it would incentivise capital investment on mining equipment and reward current miners.

Hardware Backdoors#

Malware or spyware on mining rigs or to reveal private keys.

Such an attack on mining equipment is more likely to succeed given that there are only a few manufacturers of mining equipment, and this constitutes one of Bitcoin’s most critical points of failure

Private keys and addresses can be generated on offline devices.

Bitcoiners are generally far more technically competent than the average population, and they are very meticulous about examining the hardware and software they utilize

Internet and Infrastructure Attacks#

Bitcoin is a software protocol, not a network. No single point of failure. The internet is also the protocol that allows computers to connect together - albeit via tier 0’s.

Bitcoin doesn’t need that much - only 1MB every 10 minutes (excluding adding more nodes)

Turning off the internet will damage society.

Rise in cost of nodes and drop in their numbers#

Less than a dozen nodes - allows for collution. It stops being decentralised. Unlikely as the economic incentives are against it.

The breaking of SHA256#

Hashing is a process that takes any stream of data as an input and transforms it into a dataset of fixed size (known as a hash) using a nonreversible mathematical formula.

It is easy to figure out the hash from inputted data - but hard to figure out the inputted data from the hash. With improvements in computing power it might be possible to reverse calculate the hashing functions.

The technical fix would be to move to a stronger encryption. It is likely in this case to avoid vulnerability - users will choose to hard fork.

A Return to Sound Money#

As long as the technology is useful for people, attempts at banning it will fail as people will continue to find ways of utilizing it, legally or not.

The only way is by inventing a better replacement or obviating its use.

The typewriter could never be banned or legislated out of existence, but the rise of the PC did effectively kill it.

The need is to bypass political controls and have an inflation resistant store of value.

If the gold standard returned - the demand for bitcoin would decrease.

This is extremely unlikely as governments now control education and the sheep blindly follow and believe.

Why can copycat’s not win?

Bitcoin is the only truly decentralized digital currency which has grown spontaneously as a finely balanced equilibrium between miners, coders, and users, none of whom can control it.

It was only ever possible to develop one currency based on this design, because once it became obvious that it is workable, any attempt at copying it will have been a top‐down and centrally controlled network which will never escape the control of its creators.

Altcoins#

It is incorrect to call them alt coins, they are not alternatives or competitors. They can never have the properties that make bitcoin functional as digital cash or sound money.

Bitcoin was created by an unknown.

Hal Finney passed away in August 2014.

Nakamoto left in mid-2010 for other projects - never to be heard from again.

There are 1 million bitcoins in an account run by nakamoto (most likely)

It is time to stop obsessing over the identity of Nakamoto, just as the inventor of the wheel no longer matters.

Finney and Nakamoto gone - there is no central direction or leader (unlike Linux)

It is the sovereignty of Bitcoin code, backed by proof‐of‐work, which makes it a genuinely effective solution to the double‐spending problem, and a successful digital cash

All shitcoins do not have natural demand.

This is why virtually all altcoins have a team in charge; they began the project, marketed it, designed the marketing material, and plugged press releases into the press as if they were news items, while also having the advantage of mining a large number of coins early before anybody had heard of the coins.

With a group of developers in control of the majority of coins, processing power, and coding expertise, the currency is practically a centralized currency where the interests of the team dictate its development path.

There is something deeply and fundamentally wrong about a centralized currency that adopts a highly cumbersome and inefficient design whose only advantage is the removal of a single point of failure.

Ethereum DOA (Decentralised autonomous organisation) - the first implementation of smart contracts on Ethereum - in the aftermath of the hack Ethereum developers created a new version of ethereum confiscating the attackers funds and distributing to victims.

The second largest network in terms of processing power can have its blockchain record altered when it goes in a way not suiting the development team - the notion that it is regulated by processing power is false.

The concentration of power - defeats the purpose of the blockchain.

Ethereum has not decided on its monetary policy - it is up for discussion.

Non‐Bitcoin digital currencies are, in the aggregate, easy money.

Blockchain Technology#

Perhaps the most persistent and high‐profile confusion is the notion that a mechanism that is part of Bitcoin’s operation—putting transactions into blocks which are chained together to form the ledger—can somehow be deployed to solve or improve economic or social problems, or even “revolutionize” them, as is the wont of every newfangled overhyped toy invented these days.

The only possible uses of this technology are in avenues where removing third‐party intermediation is of such paramount value to end users that it justifies the increased cost and lost efficiency.

The nature of sound money, as explained earlier, lies precisely in the fact that no human is able to control it, and hence, a predictable immutable algorithm is uniquely suited for this task

Potential applciations of BLockchain Technology#

Digital payments#

Removing the need for a trusted third party. Nodes compete to verify transactions - no single node need be trusted.

Contracts#

Code is law - smart contracts. Problem is there is a handful of people that understand smart contracts. Those proficient take advantage of those that are not.

Smart contracts have not replaced courts with code, but they have replaced courts with software developers with little experience, knowledge, or accountability in arbitrating.

The only existing meaningful blockchain contract applications are for simple time‐programmed payments and multi‐signature wallets, all of which are performed with the currency of the blockchain itself, mostly on the Bitcoin network.

Database and Record Management#

Blockchain is a reliable and tamper‐proof database and asset register, but only for the blockchain’s native currency and only if the currency is valuable enough for the network to have strong enough processing power to resist attack.

Drawbacks of Blockchain Technology#

- Redundancy - sharing exact copies of the information and the many compute resources required - has no benefit.

- Scaling - All nodes storing all transactions will have storage and computation exponentially increase. Why second layer networks for speed and efficiency are centralised and off the blockchain.

- Regulatory Compliance - Government or authority can do nothing. It cannot be regulated - it is self regulating by concensus. You cannot regulate the blockchain.

- Irreversibility - A reversal can only happen through a fork. It replicates cash transactions - online.

- Security - reliant on expenditure of processing power on verification of transactions and proof-of-work.

For every other blockchain project which was established by imitating Bitcoin’s design, there was always a single group responsible for setting the rules of the system, and thus having the ability to change them. Whereas Bitcoin grew around the set of established consensus rules through human action, all other projects grew by active human design and management.

For this system to be secure, the verifiers who expend the processing power have to be compensated in the currency of the payment system itself, to align their incentive with the health and longevity of the network.

An open decentralized system built on verification by processing power is more secure the more open the system and the larger the number of network members expending processing power on verification.

Bitcoin’s creator was motivated by creating a “peer‐to‐peer electronic cash”, and he built a design for that end.

Calling something a waste - is an opinion. A consumer has chosen so clearly not a waste to him.

If there is no victim - it is no crime.