Finding Outliers And Bad Data In Stock Data

How do you identity extreme outliers that probably mean bad stock data#

I get stock data from an API service. I get stock prices in ZAC (South African Cents) as the stocks here are measured in South African cents. Sometimes the data provider gets things wrong and returns data in ZAR (South African Rands).

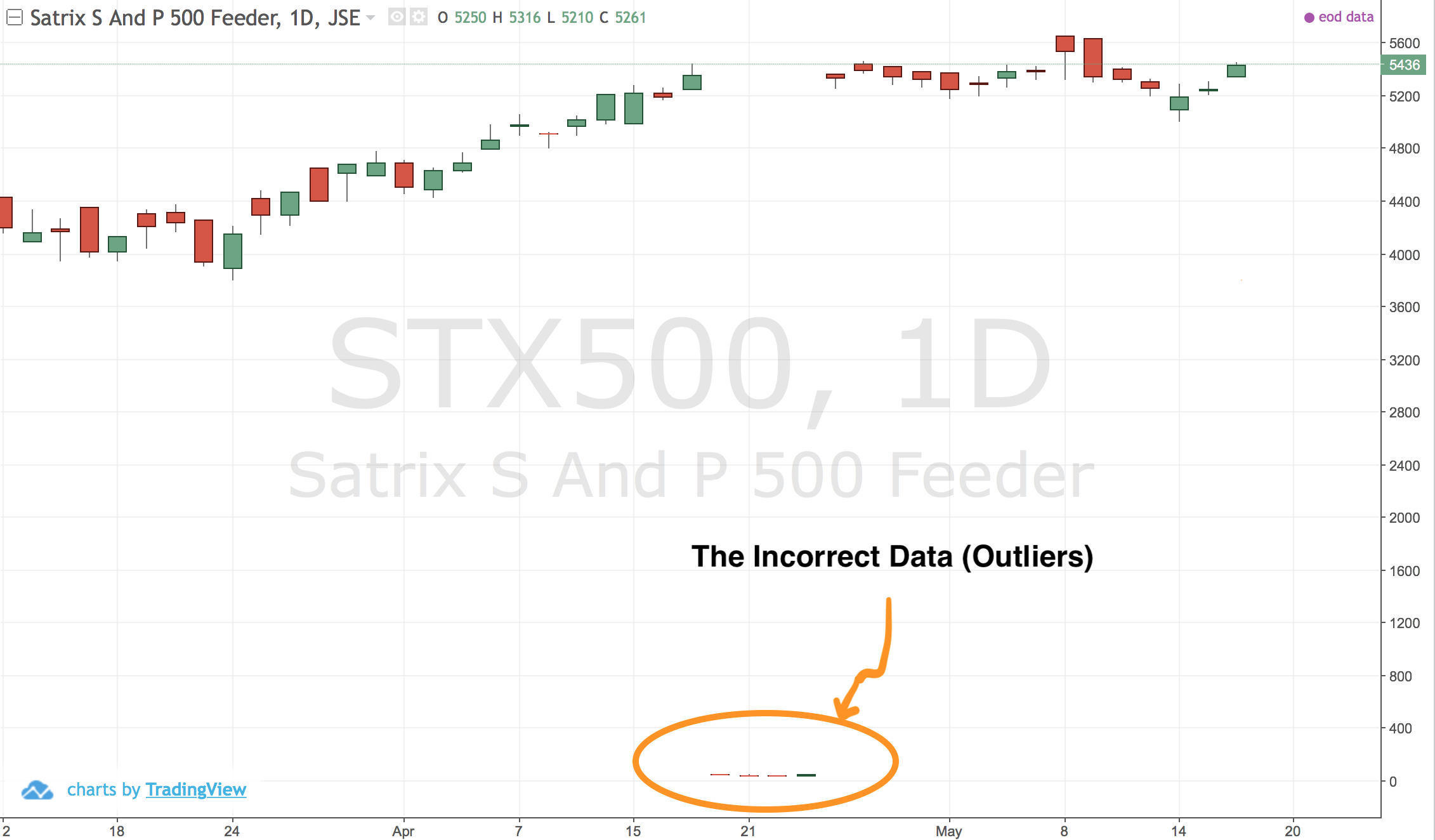

I then create charts with this data and the chart gets messed up:

I wanted to fix this error over all stock tickers and stared reasearching ways to detect outliers.

It turns out detecting outliers is a huge topic in itself and has many methods you can use

Here is as example of the data:

iddly close hgh lw ... low volume high date

634 19763448 5216.00 5219.000000 4985.000000 ... 4985.00 80613 5219.00 2020-04-14

635 19764373 5230.00 5281.000000 5000.000000 ... 5000.00 54536 5281.00 2020-04-15

636 19765306 52.14 52.650000 51.700000 ... 51.70 27823 52.65 2020-04-16

637 19766199 53.55 54.490000 52.560000 ... 52.56 111940 54.49 2020-04-17

638 19769872 53.47 54.580000 52.710000 ... 52.71 53734 54.58 2020-04-20

639 19769873 52.55 53.700000 52.210000 ... 52.21 41918 53.70 2020-04-21

640 19769874 52.46 53.080000 52.150000 ... 52.15 53420 53.08 2020-04-22

641 19769875 53.91 54.230000 52.600000 ... 52.60 18930 54.23 2020-04-23

642 19769876 53.46 53.750000 52.570000 ... 52.57 61954 53.75 2020-04-24

643 19772580 54.00 54.690000 53.720000 ... 53.72 98068 54.69 2020-04-28

644 19772581 5354.00 5425.000000 5281.000000 ... 5281.00 62498 5425.00 2020-04-29

645 19776752 5332.00 5390.000000 5269.000000 ... 5269.00 53918 5390.00 2020-04-30

646 19779540 5261.00 5385.000000 5181.000000 ... 5181.00 234668 5385.00 2020-05-04

647 19779541 5299.00 5349.000000 5199.000000 ... 5199.00 25726 5349.00 2020-05-05

648 19779542 5394.00 5435.000000 5265.000000 ... 5265.00 63998 5435.00 2020-05-06

649 19782351 5395.00 5427.000000 5326.000000 ... 5326.00 66404 5427.00 2020-05-07

650 19782352 5550.00 5657.000000 5325.000000 ... 5325.00 36062 5657.00 2020-05-08

651 19782353 5353.00 5640.000000 5300.000000 ... 5300.00 139934 5640.00 2020-05-11

What happens is whever this happens, the datapoints are divided by 100. So how can we detect this?

Methods#

The nature of the data means there are fluctuations in stock price sometimes huge one’s like 90%.

Also over the history of a stock it may go from 10 to 9000, hence the quantiles won’t catch a recent price / 100.

You can also get the mean and standard deviation and then use that to clip the edges of the bell. In that case you would need data that is of the standard distribution. Ie. Not stock data.

None the less the standard deviation method is often called the z-score.

Formula for Z score = (Observation — Mean)/Standard Deviation

I took the single column from the data and ran the zscore over it:

from scipy import stats

import numpy as np

y = df['close']

z_score = stats.zscore(y)

z = np.abs(z_score)

So summarising that into a single call

all_outliers = df[np.abs(stats.zscore(df['close'])) > 3]

It does find all our outliers

ipdb> all_outliers

iddly close hgh lw vlm ... open low volume high date

636 19765306 52.14 52.650000 51.700000 27823 ... 52.30 51.70 27823 52.65 2020-04-16

637 19766199 53.55 54.490000 52.560000 111940 ... 52.56 52.56 111940 54.49 2020-04-17

638 19769872 53.47 54.580000 52.710000 53734 ... 54.58 52.71 53734 54.58 2020-04-20

639 19769873 52.55 53.700000 52.210000 41918 ... 52.60 52.21 41918 53.70 2020-04-21

640 19769874 52.46 53.080000 52.150000 53420 ... 52.50 52.15 53420 53.08 2020-04-22

641 19769875 53.91 54.230000 52.600000 18930 ... 52.60 52.60 18930 54.23 2020-04-23

642 19769876 53.46 53.750000 52.570000 61954 ... 53.69 52.57 61954 53.75 2020-04-24

643 19772580 54.00 54.690000 53.720000 98068 ... 54.50 53.72 98068 54.69 2020-04-28

Unfortunately only in this case.

So I looked at this answer that looks for a change of 50% from the previous day. Then gets the range of this index:

bad_idx = df.index[df['close'].pct_change().abs().ge(0.5)]

outliers = df.loc[(df.index >= bad_idx.min()) & (df.index < bad_idx.max())]

But this only works if there is only 1 continuous instance of bad data.

Source#

- Stackoverflow: Detect and exclude outliers in pandas dataframe

- Stackoverflow: How to replace outlier data in pandas

- TowardsDatascience: Ways to detect and remove outliers

- Medium: Finding outliers in dataset using python

- Nextjournal: How to Remove outliers in Data with Pandas

- MachineLearningMastery: How to Remove Outliers for Machine Learning