Mastering Bitcoin Notes

Mastering Bitcoin Notes#

1. Introduction#

- Bitcoin - collection of concepts and technology forming the basis of digital money

- Units of currency called bitcoin are used to store and transmit value on the bitcoin network.

- Communicate primarily with the internet

- Users transfer bitcoin on the network - to buy, sell, send money and extend credit.

- Can be purchased and sold for other currencies at exchanges

Perfect form of money for the internet - entirely virtual, fast, secure and borderless

- The coins are just implied transactions

- Users own private keys that allow them to prove ownership of bitcoin in the bitcoin network

- The keys are used to sign transactions and transfer them to other participants

- Possession of the key is the only prerequisite - putting control in the hands of the owner - their own bank. No trusted third party is required

- No central point of control

Mining#

- Bitcoin are created through mining - competing to find solutions to a mathematical problem while processing bitcoin transactions

- Any participant in the bitcoin network (i.e., anyone using a device running the full bitcoin protocol stack) may operate as a miner, using their computer’s processing power to verify and record transactions.

- Bitcoin mining decentralizes the currency-issuance and clearing functions of a central bank and replaces the need for any central bank

- The bitcoin protocol includes built-in algorithms that regulate the mining function across the network - on average someone succeeds every 10 minutes.

- Halves rate at which new coins are created every 4 years

-

Amount in circulation follow a curve that approaches 21 million by the year 2140

21,000,000 * 10 = 210,000,000 minutes / 60 = 3,500,000 hours / 24 = 145,833 days ~= 400 years

-

Due to bitcoin’s diminishing rate of issuance, over the long term, the bitcoin currency is deflationary

- Bitcoin is also the name of the protocol - the peer-to-peer network

Bitcoin consists of 4 parts:

- Decentralised peer-to-peer network (bitcoin protocol)

- A public transaction ledger (blockchain)

- A set of rules for independent transaction validation and currency issuance (consensus rules)

- Mechanism for reaching global decentralized consensus on the valid blockchain (proof-of-work algorithm)

Digital Currencies#

3 basic questions for those accepting digital money:

- Can I trust it is not counterfeit and authentic?

- Can I trust it can only be spent once?

- Can no one else claim this money belongs to them?

For digital money - cryptography for the basis of the legitimacy of a user’s claim to value

Digital signatures enable a user to sign a transaction proving the ownrship of that asset.

Centralisation of early currencies made them fail. Parent companies and governments regulated and litigated them out of existence.

History of Bitcoin#

Invented in 2008 with the publication of Bitcoin: A Peer-to-Peer Electronic Cash System - under the alias “Satoshi Nakamoto”.

Used prior inventions b-money and HashCash to create a decentrlaised currency issuance and validation system.

The Key innovation was the proof-of-work algorithm to conduct a global election every 10 minutes - allowing the network to arrive at a consensus every 10 minutes about the state of transactions.

Solving the double spend problem needing a central clearing house.

The bitcoin network started in 2009 based on a reference implementation by nakamoto.

The implmentation of the proof-of-work algorithm (mining) has increased in power exponentially.

Satoshi Nakamoto withdrew from the public in April 2011.

See: Byzantine Generals’ Problem

Bitcoin uses, users and their stories#

At its core, money simply facilitates the exchange of value between people

Getting Started#

Bitcoin is a protocol that can be accessed using a client application that speaks the protocol.

A bitcoin wallet is the most common interface into the bitcoin protocol.

Just like a web browser is the most common interface into the HTTP protocol.

There are many implementations of wallets, just like browsers (firefox, brave, safari etc.)

Bitcoin wallets vary in quality, performance, privacy adn reliability.

There is also a reference implementation called Bitcoin Core.

Types of Wallets#

- Desktop wallet - Running on desktop OS

- Mobile wallet - iOS or Android

- Web wallet - Accessed through web browser, wallet is stored by third party. Take control of bitcoin keys.

- Hardware wallet - secure self-contained bitcoin wallet. Considered secure and suitabel for storing large amounts.

- Paper wallet - keys are printed for long term storage.

Another way to categorise clients:

- Full node: client that stores the entire hsitory of bitcoin transactions, can intiiate transactions directly on the bitcoin network. Handles all aspects of the protocol and can independently validate the entire blockchain.

- Lightweight client: SPV (Simple payment verification) connects to full nodes for access to transaction history - but stores the user wallet locally. Indepently creating, validating and transmitting transactions.

- Third party API client: Interacts with bitcoin through a third party API rather than connecting to the network directly.

Most important information is the bitcoin address…a QR code contains the same information.

Example bitcoin address: 1Cdid9KFAaatwczBwBttQcwXYCpvK8h7FK

Bitcoin addresses start with

1or3. There is nothing sensitive about a bitcoin address. It can be posted anywhere and you can create new addresses as often as you like. All of which will direct funds to your wallet. Many modern wallets create a new address for every transaction to maximise privacy.

a wallet is collection of addresses and the keys that unlock the funds within

Each address has a corresponding private key.

Until the moment this address is referenced as the recipient of value in a transaction posted on the bitcoin ledger, the bitcoin address is simply part of the vast number of possible addresses that are valid in bitcoin

Getting your first Bitcoin#

Bitcoin transactions are irreversable

For someone selling bitcoin, this difference introduces a very high risk that the buyer will reverse the electronic payment after they have received bitcoin, in effect defrauding the seller. To mitigate this risk, companies accepting traditional electronic payments in return for bitcoin usually require buyers to undergo identity verification and credit-worthiness checks, which may take several days or weeks.

Methods for getting bitcoin:

- From a friend

- Local classified for cash in area

- Earn bitcoin by selling a product or service

- Use a bitcoin ATM - accepts cash and sends bitcoin

- Use a bitcoin exchange

One advantage of bitcion is the enhanced privacy. Acquiring, holding and spending does not require giving personal information to 3rd parties.

Where bitcoin touches traditional systems - exchanges - regulations apply.

Users should be aware that once a bitcoin address is attached to an identity, all associated bitcoin transactions are also easy to identify and track.

This is one reason many users choose to maintain dedicated exchange accounts unlinked to their wallets.

mistakes are irreversable

When sending money:

- A transaction is made and signed with the sender’s private key

- the transaction is transmitted via P2P protocol - propagating around the network nodes within seconds.

- The receiver is constantly listening to published transactions on the ledger - looking for any transactinos that match her wallet.

Confirmations - Inital transactions show as

unconfirmed. Meaning transaction has been propagated to the network but not recorded in the ledger - the blockchain. Transactions must be included in a block - this is done every 10 minutes.

2. How Bitcoin Works#

- Based on decentralised trust. Not a central authority.

The bitcoin system consists of:

- wallets - keys and addresses

- transactions - propagated over the network

- miners - produce the consensus blockchain through competitive computation

Bitcoin explorers:

- https://live.blockcypher.com/

- https://www.blockchain.com/explorer

- https://bitpay.com/insight/#/ALL/mainnet/home

A business will present a payment request QR code. That contains:

- destination bitcoin address

- payment amount

- generic description

Helps the wallet to prefill information.

Eg.

bitcoin:1GdK9UzpHBzqzX2A9JFP3Di4weBwqgmoQA?

amount=0.015&

label=Bob%27s%20Cafe&

message=Purchase%20at%20Bob%27s%20Cafe

A 1/100,000,000 of a bitcoin is called a

satoshi

Transactions to that wallet can be seen at: https://live.blockcypher.com/btc/address/1GdK9UzpHBzqzX2A9JFP3Di4weBwqgmoQA/

I could not find the exact transaction on that page.

Bitcoin Transactions#

In simple terms the owner of some bitcoin authorizes the transfer to another owner. A chain of ownership.

Inputs and outputs to a transaction are not always equal. Outputs are slightly less than input due to a transaction fee. A small payment that a miner receives.

The transaction also contains a proof of ownership of the amount being spent in the form of a digital signature. Spending is signing a transaction - from a previous owner to a specific bitcoin address.

If you only had an existing 20 bitcoin tranasction, trying to buy an item costing 5 bitcoin. Then you would pay 20 bitcoin - 5 bitcoin to the store owner - 15 bitcoin back to yourself (less the transaction fee).

This change address does not have to be the same address as the input, for privacy reasons it is often a new address from the owner’s wallet.

Wallets create the aggregate amount in different ways - some take many small transactions to make the exact amount. The transaction will generate change - similar to how you get change at a shop.

Transactions move value from transaction inputs to transacton outputs

Common Transactions#

A purchase with change.

Input 0 (from Alice signed by Alice) -> Output 0 (To bob)

-> Output 1 (To alice - change)

Aggregates many transactions into a single one - piling up coins.

Input 0 -> Output 0

Input 1 ->

Input 2 ->

Input 3 ->

One input to multiple participants (payroll)

Input 0 -> Output 0

Output 1

Output 2

Output 3

...

Output n

Constructing a Transaction#

Alice just sets a destination and an amount - the wallet does the rest.

A wallet application can construct transactions even if it is completely offline.

A transaction does not need to be constructed and signed while connected to the bitcoin network

Most wallets keep track of available outputs belonging to addresses in the wallet.

A bitcoin wallet application that runs as a full-node client actually contains a copy of every unspent output from every transaction in the blockchain

Lightweight clients only track the user’s own unspect outputs.

If a wallet does not keep the transactions - it can query the network

Lets look up the inspent outputs from Alice’s bitcoin address:

http https://blockchain.info/unspent?active=1Cdid9KFAaatwczBwBttQcwXYCpvK8h7FK

{

"notice": "",

"unspent_outputs":

[

{

"confirmations": 378773,

"script": "76a9147f9b1a7fb68d60c536c2fd8aeaa53a8f3cc025a888ac",

"tx_hash": "f2c245c38672a5d8fba5a5caa44dcef277a52e916a0603272f91286f2b052706",

"tx_hash_big_endian": "0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2",

"tx_index": 0,

"tx_output_n": 1,

"value": 8450000,

"value_hex": "0080efd0"

},

{

"confirmations": 323156,

"script": "76a9147f9b1a7fb68d60c536c2fd8aeaa53a8f3cc025a888ac",

"tx_hash": "0365fdc169b964ea5ad3219e12747e9478418fdc8abed2f5fe6d0205c96def29",

"tx_hash_big_endian": "29ef6dc905026dfef5d2be8adc8f4178947e74129e21d35aea64b969c1fd6503",

"tx_index": 0,

"tx_output_n": 0,

"value": 100000,

"value_hex": "0186a0"

},

{

"confirmations": 315315,

"script": "76a9147f9b1a7fb68d60c536c2fd8aeaa53a8f3cc025a888ac",

"tx_hash": "d9717f774daab8d3dd470853204394c82e3c01097479575d6d2ee97d7b3bdfa1",

"tx_hash_big_endian": "a1df3b7b7de92e6d5d57797409013c2ec8944320530847ddd3b8aa4d777f71d9",

"tx_index": 0,

"tx_output_n": 0,

"value": 1000000,

"value_hex": "0f4240"

},

...

]

}

View the transaction of Joe to Alice

Creating Outputs#

Alice’s transaction says: This output is payable to whoever can present a signature from the key corresponding to Bob’s public address.

Only Bob has the corresponding keys for that address, only Bob’s wallet can present a a signature to redeem it.

Alice will encumber the output value with a demand for a signature from Bob.

Alice’s change payment is created by her wallet.

For a transaction to be processed in a timely fashion the wallet will add a small fee. The fee is not explicit - it is implied. It is the remainder of the outputs - the transaction fee

The transaction from Alice to Bob’s cafe can be seen here

Adding the Transaction to the Ledger#

The transaction created is 258 bytes long. Now the transaction msut be transmitted to the bitcoin network.

The transaction must become part of a block, the block must be mined and the new block must be added to the blockchain.

The bitcoin network is peer-to-peer - so blocks are propagated to all participants.

The transaction can be sent to any bitcoin node - a computer speaking the bitcoin protoocol.

Any bitcoin node receiving a valid transaction it has not seen before will forward it to all other nodes it is connected to…called flooding. The transaction reaches a large percentage of nodes in a few seconds.

Bob’s wallet can confirm:

- transaction is well formed

- uses previously unspent inputs

- contains sufficient transaction fees to be included in the next block

Bob can assume that the transaction will be inlcuded in the next block - you know what they say about assumptions

A common misconception is that bitcon transactions must be confirmed by waiting 10 minutes for a new block or up to 60 minutes for 6 full confirmations. Confirmations ensure the transaction has been accepted by the whole network. This shouldn’t be needed for small purchases - same as credit card these days.

Bitcoin Mining#

A transaction does not become part of the blockchain until it is verified and included in a block called: mining.

Bitcoin trust is based on computation. Transactions are bundled into blocks - which require an enormous amount of computation to prove but a small amount to verify.

Mining has 2 purposes:

- Validate transactions by reference to bitoin’s concensus rules

- Mining creates new bitcoin in each block - dminishing amount of bitcoin

Mining achieves a fine balance between cost and reward. Mining uses electricity to solve a mathematical problem. A successful miner will collect a reward in the form of new bitcoin and transaction fees - only if validated based on a consensus.

A good way to describe mining is like a giant competitive game of sudoku that resets every time someone finds a solution and whose difficulty automatically adjusts so that it takes approximately 10 minutes to find a solution. Sodoku can be verified quickly.

The solutions to a block of transactions called proof-of-work.

The algorithm involves repeatedly hashing the header of a block and a random number with SHA256 hashing until a solution matching the pattern emerges.

The first miner to find the solution wins and publishes it to the blockchain.

It is profitable only to mine with application-specific integrated circuits (ASICs) - hundreds of mining algorithms, printed in hardware - running on a silicon chip.

Mining transactions in Blocks#

Once a new block is published all work moves to the new block. Each miner adds unverified transactions to the block - along with the block reward and sum of the transaction fees for the block sent to his bitcoin address. If his solutions is accepted the payment to his bitcoin address is validated and added to the blockchain.

A candidate block is the enw block.

The block containing a transaction is a single confirmation. Each block on top of Alice’s transaction is another confirmation. Harder to reverse == more trusted.

By conventino more than 6 confirmations is irrevocable.

Spending the Transaction#

Full node clients can track the moment of generation in a block until reaching a certain address.

SPV (Simple payment verification) nodes check that a transaciton exists in the blockchain and has a few blocks added after it.

Transactions build a chain

3. Bitcoin Core: The reference implementation#

Bitcoin is an open source proejct and is available under the MIT license.

The software was completed before the whitepaper was written.

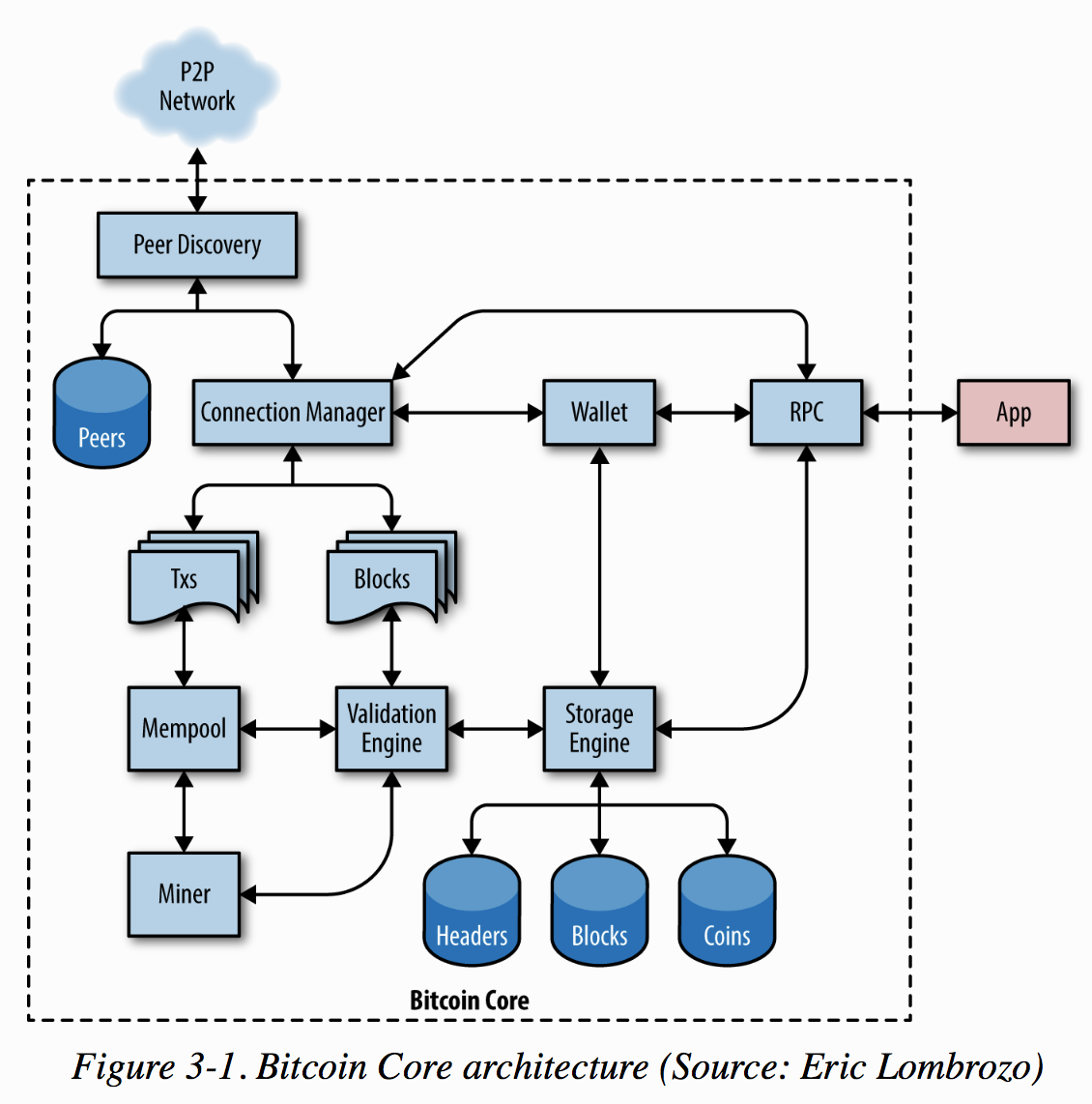

The satoshi client has evolved into bitcoin core. Bitcoin core is the reference implementation of the bitcoin system.

Bitcoin coin implements all aspects of bitcoin:

- wallet

- transaction and block validation engine

- full network node in peer-to-peer network

Bitcoin core’s wallet is not meant to be used as a production wallet

Application developers are advised to build wallets with modern standards such as BIP-39 and BIP-32.

A BIP is a Bitcoin improvement proposal.

At time of writing (November 2020) most recent version was v0.20.1.

Running a Bitcoin core node#

By running a node, you don’t have to rely on any third party to validate a transaction

Bitcoin core keeps a full record of all transactions - the blockchain - since inception in 2009.

Why would you want to run a node:

- Developing - a node for API access to the network

- Building applications that must validate transactions according to concensus rules

- To support bitcoin - more robust network

- If you do not want to rely on a third party to validate your transactions

It starts getting deep…more reading in the book

Setting up a node on Raspberry Pi#

I wrote a post on setting up a bitcoin full node with a raspberry pi on ubuntu 20.04 - the instuctions may have become outdated and I cannot gaurantee the security or configuration settings.

Configuring your Node#

To disable the reference wallet implementation, in your ~/.bitcoin/bitcoin.conf file set:

disablewallet=1

You can check where the binaries are with:

$ which bitcoind

/usr/local/bin/bitcoind

$ which bitcoin-cli

/usr/local/bin/bitcoin-cli

Running a bitcoin node#

Bitcoin’s peer to peer network is run by volunteers and businesses. Those running nodes have a direct and authoritive view of the bitcoin blockchain - a local copy of all transactions independently validated by the node.

By running a node you do not need to rely on a third party to validate a transaction

The bitcoin block chain - all transactions - is about 370GB as of July 2021.

You can run a testnet node which is only 17GB as of July 2021 with setting in bitcoin.conf:

testnet=1

Why would you want to run a node:

- developing bitcoin software using local node api

- Support bitcoin - making the network more robust

- If you do not want to rely on a third party to validate transactions

Running a node the first time#

The first time you run a node it will ask you to create a strong password for JSON RPC - the bitcoin api.

$ bitcoind

Error: To use the "-server" option, you must set a rpcpassword in the configuration file:

/home/ubuntu/.bitcoin/bitcoin.conf

It is recommended you use the following random password:

rpcuser=bitcoinrpc

rpcpassword=2XA4DuKNCbtZXsBQRRNDEwEY2nM6M4H

I think the

rpcconfig is deprecated now in favour of something else

Configuring the bitcoin code node#

You can see config options with:

$ bitcoind --help

Bitcoin Core version v0.21.0

Usage: bitcoind [options] Start Bitcoin Core

Options:

-?

Print this help message and exit

-alertnotify=<cmd>

Execute command when a relevant alert is received or we see a really

long fork (%s in cmd is replaced by message)

-assumevalid=<hex>

If this block is in the chain assume that it and its ancestors are valid

and potentially skip their script verification (0 to verify all,

default:

0000000000000000000b9d2ec5a352ecba0592946514a92f14319dc2b367fc72,

testnet:

000000000000006433d1efec504c53ca332b64963c425395515b01977bd7b3b0,

signet:

0000002a1de0f46379358c1fd09906f7ac59adf3712323ed90eb59e4c183c020)

-blockfilterindex=<type>

Maintain an index of compact filters by block (default: 0, values:

basic). If <type> is not supplied or if <type> = 1, indexes for

all known types are enabled.

-blocknotify=<cmd>

Execute command when the best block changes (%s in cmd is replaced by

block hash)

-blockreconstructionextratxn=<n>

Extra transactions to keep in memory for compact block reconstructions

(default: 100)

-blocksdir=<dir>

Specify directory to hold blocks subdirectory for *.dat files (default:

<datadir>)

-blocksonly

Whether to reject transactions from network peers. Automatic broadcast

and rebroadcast of any transactions from inbound peers is

disabled, unless the peer has the 'forcerelay' permission. RPC

transactions are not affected. (default: 0)

-conf=<file>

Specify path to read-only configuration file. Relative paths will be

prefixed by datadir location. (default: bitcoin.conf)

-daemon

Run in the background as a daemon and accept commands

-datadir=<dir>

Specify data directory

-dbcache=<n>

Maximum database cache size <n> MiB (4 to 16384, default: 450). In

addition, unused mempool memory is shared for this cache (see

-maxmempool).

-debuglogfile=<file>

Specify location of debug log file. Relative paths will be prefixed by a

net-specific datadir location. (-nodebuglogfile to disable;

default: debug.log)

-includeconf=<file>

Specify additional configuration file, relative to the -datadir path

(only useable from configuration file, not command line)

-loadblock=<file>

Imports blocks from external file on startup

-maxmempool=<n>

Keep the transaction memory pool below <n> megabytes (default: 300)

-maxorphantx=<n>

Keep at most <n> unconnectable transactions in memory (default: 100)

-mempoolexpiry=<n>

Do not keep transactions in the mempool longer than <n> hours (default:

336)

-par=<n>

Set the number of script verification threads (-4 to 15, 0 = auto, <0 =

leave that many cores free, default: 0)

-persistmempool

Whether to save the mempool on shutdown and load on restart (default: 1)

-pid=<file>

Specify pid file. Relative paths will be prefixed by a net-specific

datadir location. (default: bitcoind.pid)

-prune=<n>

Reduce storage requirements by enabling pruning (deleting) of old

blocks. This allows the pruneblockchain RPC to be called to

delete specific blocks, and enables automatic pruning of old

blocks if a target size in MiB is provided. This mode is

incompatible with -txindex and -rescan. Warning: Reverting this

setting requires re-downloading the entire blockchain. (default:

0 = disable pruning blocks, 1 = allow manual pruning via RPC,

>=550 = automatically prune block files to stay under the

specified target size in MiB)

-reindex

Rebuild chain state and block index from the blk*.dat files on disk

-reindex-chainstate

Rebuild chain state from the currently indexed blocks. When in pruning

mode or if blocks on disk might be corrupted, use full -reindex

instead.

-settings=<file>

Specify path to dynamic settings data file. Can be disabled with

-nosettings. File is written at runtime and not meant to be

edited by users (use bitcoin.conf instead for custom settings).

Relative paths will be prefixed by datadir location. (default:

settings.json)

-startupnotify=<cmd>

Execute command on startup.

-sysperms

Create new files with system default permissions, instead of umask 077

(only effective with disabled wallet functionality)

-txindex

Maintain a full transaction index, used by the getrawtransaction rpc

call (default: 0)

-version

Print version and exit

Connection options:

-addnode=<ip>

Add a node to connect to and attempt to keep the connection open (see

the `addnode` RPC command help for more info). This option can be

specified multiple times to add multiple nodes.

-asmap=<file>

Specify asn mapping used for bucketing of the peers (default:

ip_asn.map). Relative paths will be prefixed by the net-specific

datadir location.

-bantime=<n>

Default duration (in seconds) of manually configured bans (default:

86400)

-bind=<addr>[:<port>][=onion]

Bind to given address and always listen on it (default: 0.0.0.0). Use

[host]:port notation for IPv6. Append =onion to tag any incoming

connections to that address and port as incoming Tor connections

(default: 127.0.0.1:8334=onion, testnet: 127.0.0.1:18334=onion,

signet: 127.0.0.1:38334=onion, regtest: 127.0.0.1:18445=onion)

-connect=<ip>

Connect only to the specified node; -noconnect disables automatic

connections (the rules for this peer are the same as for

-addnode). This option can be specified multiple times to connect

to multiple nodes.

-discover

Discover own IP addresses (default: 1 when listening and no -externalip

or -proxy)

-dns

Allow DNS lookups for -addnode, -seednode and -connect (default: 1)

-dnsseed

Query for peer addresses via DNS lookup, if low on addresses (default: 1

unless -connect used)

-externalip=<ip>

Specify your own public address

-forcednsseed

Always query for peer addresses via DNS lookup (default: 0)

-listen

Accept connections from outside (default: 1 if no -proxy or -connect)

-listenonion

Automatically create Tor onion service (default: 1)

-maxconnections=<n>

Maintain at most <n> connections to peers (default: 125)

-maxreceivebuffer=<n>

Maximum per-connection receive buffer, <n>*1000 bytes (default: 5000)

-maxsendbuffer=<n>

Maximum per-connection send buffer, <n>*1000 bytes (default: 1000)

-maxtimeadjustment

Maximum allowed median peer time offset adjustment. Local perspective of

time may be influenced by peers forward or backward by this

amount. (default: 4200 seconds)

-maxuploadtarget=<n>

Tries to keep outbound traffic under the given target (in MiB per 24h).

Limit does not apply to peers with 'download' permission. 0 = no

limit (default: 0)

-networkactive

Enable all P2P network activity (default: 1). Can be changed by the

setnetworkactive RPC command

-onion=<ip:port>

Use separate SOCKS5 proxy to reach peers via Tor onion services, set

-noonion to disable (default: -proxy)

-onlynet=<net>

Make outgoing connections only through network <net> (ipv4, ipv6 or

onion). Incoming connections are not affected by this option.

This option can be specified multiple times to allow multiple

networks.

-peerblockfilters

Serve compact block filters to peers per BIP 157 (default: 0)

-peerbloomfilters

Support filtering of blocks and transaction with bloom filters (default:

0)

-permitbaremultisig

Relay non-P2SH multisig (default: 1)

-port=<port>

Listen for connections on <port>. Nodes not using the default ports

(default: 8333, testnet: 18333, signet: 38333, regtest: 18444)

are unlikely to get incoming connections.

-proxy=<ip:port>

Connect through SOCKS5 proxy, set -noproxy to disable (default:

disabled)

-proxyrandomize

Randomize credentials for every proxy connection. This enables Tor

stream isolation (default: 1)

-seednode=<ip>

Connect to a node to retrieve peer addresses, and disconnect. This

option can be specified multiple times to connect to multiple

nodes.

-timeout=<n>

Specify connection timeout in milliseconds (minimum: 1, default: 5000)

-torcontrol=<ip>:<port>

Tor control port to use if onion listening enabled (default:

127.0.0.1:9051)

-torpassword=<pass>

Tor control port password (default: empty)

-upnp

Use UPnP to map the listening port (default: 0)

-whitebind=<[permissions@]addr>

Bind to the given address and add permission flags to the peers

connecting to it. Use [host]:port notation for IPv6. Allowed

permissions: bloomfilter (allow requesting BIP37 filtered blocks

and transactions), noban (do not ban for misbehavior; implies

download), forcerelay (relay transactions that are already in the

mempool; implies relay), relay (relay even in -blocksonly mode,

and unlimited transaction announcements), mempool (allow

requesting BIP35 mempool contents), download (allow getheaders

during IBD, no disconnect after maxuploadtarget limit), addr

(responses to GETADDR avoid hitting the cache and contain random

records with the most up-to-date info). Specify multiple

permissions separated by commas (default:

download,noban,mempool,relay). Can be specified multiple times.

-whitelist=<[permissions@]IP address or network>

Add permission flags to the peers connecting from the given IP address

(e.g. 1.2.3.4) or CIDR-notated network (e.g. 1.2.3.0/24). Uses

the same permissions as -whitebind. Can be specified multiple

times.

Wallet options:

-addresstype

What type of addresses to use ("legacy", "p2sh-segwit", or "bech32",

default: "bech32")

-avoidpartialspends

Group outputs by address, selecting all or none, instead of selecting on

a per-output basis. Privacy is improved as an address is only

used once (unless someone sends to it after spending from it),

but may result in slightly higher fees as suboptimal coin

selection may result due to the added limitation (default: 0

(always enabled for wallets with "avoid_reuse" enabled))

-changetype

What type of change to use ("legacy", "p2sh-segwit", or "bech32").

Default is same as -addresstype, except when

-addresstype=p2sh-segwit a native segwit output is used when

sending to a native segwit address)

-disablewallet

Do not load the wallet and disable wallet RPC calls

-discardfee=<amt>

The fee rate (in BTC/kB) that indicates your tolerance for discarding

change by adding it to the fee (default: 0.0001). Note: An output

is discarded if it is dust at this rate, but we will always

discard up to the dust relay fee and a discard fee above that is

limited by the fee estimate for the longest target

-fallbackfee=<amt>

A fee rate (in BTC/kB) that will be used when fee estimation has

insufficient data. 0 to entirely disable the fallbackfee feature.

(default: 0.00)

-keypool=<n>

Set key pool size to <n> (default: 1000). Warning: Smaller sizes may

increase the risk of losing funds when restoring from an old

backup, if none of the addresses in the original keypool have

been used.

-maxapsfee=<n>

Spend up to this amount in additional (absolute) fees (in BTC) if it

allows the use of partial spend avoidance (default: 0.00)

-mintxfee=<amt>

Fees (in BTC/kB) smaller than this are considered zero fee for

transaction creation (default: 0.00001)

-paytxfee=<amt>

Fee (in BTC/kB) to add to transactions you send (default: 0.00)

-rescan

Rescan the block chain for missing wallet transactions on startup

-spendzeroconfchange

Spend unconfirmed change when sending transactions (default: 1)

-txconfirmtarget=<n>

If paytxfee is not set, include enough fee so transactions begin

confirmation on average within n blocks (default: 6)

-wallet=<path>

Specify wallet path to load at startup. Can be used multiple times to

load multiple wallets. Path is to a directory containing wallet

data and log files. If the path is not absolute, it is

interpreted relative to <walletdir>. This only loads existing

wallets and does not create new ones. For backwards compatibility

this also accepts names of existing top-level data files in

<walletdir>.

-walletbroadcast

Make the wallet broadcast transactions (default: 1)

-walletdir=<dir>

Specify directory to hold wallets (default: <datadir>/wallets if it

exists, otherwise <datadir>)

-walletnotify=<cmd>

Execute command when a wallet transaction changes. %s in cmd is replaced

by TxID and %w is replaced by wallet name. %w is not currently

implemented on windows. On systems where %w is supported, it

should NOT be quoted because this would break shell escaping used

to invoke the command.

-walletrbf

Send transactions with full-RBF opt-in enabled (RPC only, default: 0)

ZeroMQ notification options:

-zmqpubhashblock=<address>

Enable publish hash block in <address>

-zmqpubhashblockhwm=<n>

Set publish hash block outbound message high water mark (default: 1000)

-zmqpubhashtx=<address>

Enable publish hash transaction in <address>

-zmqpubhashtxhwm=<n>

Set publish hash transaction outbound message high water mark (default:

1000)

-zmqpubrawblock=<address>

Enable publish raw block in <address>

-zmqpubrawblockhwm=<n>

Set publish raw block outbound message high water mark (default: 1000)

-zmqpubrawtx=<address>

Enable publish raw transaction in <address>

-zmqpubrawtxhwm=<n>

Set publish raw transaction outbound message high water mark (default:

1000)

-zmqpubsequence=<address>

Enable publish hash block and tx sequence in <address>

-zmqpubsequencehwm=<n>

Set publish hash sequence message high water mark (default: 1000)

Debugging/Testing options:

-debug=<category>

Output debugging information (default: -nodebug, supplying <category> is

optional). If <category> is not supplied or if <category> = 1,

output all debugging information. <category> can be: net, tor,

mempool, http, bench, zmq, walletdb, rpc, estimatefee, addrman,

selectcoins, reindex, cmpctblock, rand, prune, proxy, mempoolrej,

libevent, coindb, qt, leveldb, validation.

-debugexclude=<category>

Exclude debugging information for a category. Can be used in conjunction

with -debug=1 to output debug logs for all categories except one

or more specified categories.

-help-debug

Print help message with debugging options and exit

-logips

Include IP addresses in debug output (default: 0)

-logtimestamps

Prepend debug output with timestamp (default: 1)

-maxtxfee=<amt>

Maximum total fees (in BTC) to use in a single wallet transaction;

setting this too low may abort large transactions (default: 0.10)

-printtoconsole

Send trace/debug info to console (default: 1 when no -daemon. To disable

logging to file, set -nodebuglogfile)

-shrinkdebugfile

Shrink debug.log file on client startup (default: 1 when no -debug)

-uacomment=<cmt>

Append comment to the user agent string

Chain selection options:

-chain=<chain>

Use the chain <chain> (default: main). Allowed values: main, test,

signet, regtest

-signet

Use the signet chain. Equivalent to -chain=signet. Note that the network

is defined by the -signetchallenge parameter

-signetchallenge

Blocks must satisfy the given script to be considered valid (only for

signet networks; defaults to the global default signet test

network challenge)

-signetseednode

Specify a seed node for the signet network, in the hostname[:port]

format, e.g. sig.net:1234 (may be used multiple times to specify

multiple seed nodes; defaults to the global default signet test

network seed node(s))

-testnet

Use the test chain. Equivalent to -chain=test.

Node relay options:

-bytespersigop

Equivalent bytes per sigop in transactions for relay and mining

(default: 20)

-datacarrier

Relay and mine data carrier transactions (default: 1)

-datacarriersize

Maximum size of data in data carrier transactions we relay and mine

(default: 83)

-minrelaytxfee=<amt>

Fees (in BTC/kB) smaller than this are considered zero fee for relaying,

mining and transaction creation (default: 0.00001)

-whitelistforcerelay

Add 'forcerelay' permission to whitelisted inbound peers with default

permissions. This will relay transactions even if the

transactions were already in the mempool. (default: 0)

-whitelistrelay

Add 'relay' permission to whitelisted inbound peers with default

permissions. This will accept relayed transactions even when not

relaying transactions (default: 1)

Block creation options:

-blockmaxweight=<n>

Set maximum BIP141 block weight (default: 3996000)

-blockmintxfee=<amt>

Set lowest fee rate (in BTC/kB) for transactions to be included in block

creation. (default: 0.00001)

RPC server options:

-rest

Accept public REST requests (default: 0)

-rpcallowip=<ip>

Allow JSON-RPC connections from specified source. Valid for <ip> are a

single IP (e.g. 1.2.3.4), a network/netmask (e.g.

1.2.3.4/255.255.255.0) or a network/CIDR (e.g. 1.2.3.4/24). This

option can be specified multiple times

-rpcauth=<userpw>

Username and HMAC-SHA-256 hashed password for JSON-RPC connections. The

field <userpw> comes in the format: <USERNAME>:<SALT>$<HASH>. A

canonical python script is included in share/rpcauth. The client

then connects normally using the

rpcuser=<USERNAME>/rpcpassword=<PASSWORD> pair of arguments. This

option can be specified multiple times

-rpcbind=<addr>[:port]

Bind to given address to listen for JSON-RPC connections. Do not expose

the RPC server to untrusted networks such as the public internet!

This option is ignored unless -rpcallowip is also passed. Port is

optional and overrides -rpcport. Use [host]:port notation for

IPv6. This option can be specified multiple times (default:

127.0.0.1 and ::1 i.e., localhost)

-rpccookiefile=<loc>

Location of the auth cookie. Relative paths will be prefixed by a

net-specific datadir location. (default: data dir)

-rpcpassword=<pw>

Password for JSON-RPC connections

-rpcport=<port>

Listen for JSON-RPC connections on <port> (default: 8332, testnet:

18332, signet: 38332, regtest: 18443)

-rpcserialversion

Sets the serialization of raw transaction or block hex returned in

non-verbose mode, non-segwit(0) or segwit(1) (default: 1)

-rpcthreads=<n>

Set the number of threads to service RPC calls (default: 4)

-rpcuser=<user>

Username for JSON-RPC connections

-rpcwhitelist=<whitelist>

Set a whitelist to filter incoming RPC calls for a specific user. The

field <whitelist> comes in the format: <USERNAME>:<rpc 1>,<rpc

2>,...,<rpc n>. If multiple whitelists are set for a given user,

they are set-intersected. See -rpcwhitelistdefault documentation

for information on default whitelist behavior.

-rpcwhitelistdefault

Sets default behavior for rpc whitelisting. Unless rpcwhitelistdefault

is set to 0, if any -rpcwhitelist is set, the rpc server acts as

if all rpc users are subject to empty-unless-otherwise-specified

whitelists. If rpcwhitelistdefault is set to 1 and no

-rpcwhitelist is set, rpc server acts as if all rpc users are

subject to empty whitelists.

-server

Accept command line and JSON-RPC commands

You can also set options in you bitcoin.conf file:

alertnotify- run a script to alert node owner of eventsconf- alternate lcoation of config filedatadir- directory for bitcoin datamaxconnections- set max number of connections to prevent excess data usemaxmempool- maximum amount of memory for the node to useminrelaytxfee- minimum fee transaction you will relay. Used to reduce the size of the in memory transaction pool.

Transaction database options:

By default bitcoin core builds a database of transactions only relating to the user’s wallet

If you want to use getrawtransaction you need to build a complete transaction index:

txindex=1

You then need to restart

bitcoindwith thereindexoption to rebuild the index

On a dedicated raspberry pi with 8GB you might want to set with a constained internet:

maxmempool=3000

maxconnections=20

minrelaytxfee=0.0001

To run the daemon with messages in the foreground:

bitcoind -printtoconsole

To monitor info of your node:

bitcoin-cli getinfo

bitcoin-cli -getinfo

{

"version": 210000,

"blocks": 94967,

"headers": 236557,

"verificationprogress": 0.0003050917592975576,

"timeoffset": -1,

"connections": {

"in": 11,

"out": 10,

"total": 21

},

"proxy": "",

"difficulty": 8078.195257925088,

"chain": "main",

"keypoolsize": 1000,

"paytxfee": 0.00000000,

"balance": 0.00000000,

"relayfee": 0.00001000,

"warnings": ""

}

Bitcoin Core API#

Bitcoin core implements a json RPC (remote procedure call) interface.

It can be accessed with bitcoin-cli

To get available options use:

ubuntu@btc:~$ bitcoin-cli help

== Blockchain ==

getbestblockhash

getblock "blockhash" ( verbosity )

getblockchaininfo

getblockcount

getblockfilter "blockhash" ( "filtertype" )

getblockhash height

getblockheader "blockhash" ( verbose )

getblockstats hash_or_height ( stats )

getchaintips

getchaintxstats ( nblocks "blockhash" )

getdifficulty

getmempoolancestors "txid" ( verbose )

getmempooldescendants "txid" ( verbose )

getmempoolentry "txid"

getmempoolinfo

getrawmempool ( verbose mempool_sequence )

gettxout "txid" n ( include_mempool )

gettxoutproof ["txid",...] ( "blockhash" )

gettxoutsetinfo ( "hash_type" )

preciousblock "blockhash"

pruneblockchain height

savemempool

scantxoutset "action" ( [scanobjects,...] )

verifychain ( checklevel nblocks )

verifytxoutproof "proof"

== Control ==

getmemoryinfo ( "mode" )

getrpcinfo

help ( "command" )

logging ( ["include_category",...] ["exclude_category",...] )

stop

uptime

== Generating ==

generateblock "output" ["rawtx/txid",...]

generatetoaddress nblocks "address" ( maxtries )

generatetodescriptor num_blocks "descriptor" ( maxtries )

== Mining ==

getblocktemplate ( "template_request" )

getmininginfo

getnetworkhashps ( nblocks height )

prioritisetransaction "txid" ( dummy ) fee_delta

submitblock "hexdata" ( "dummy" )

submitheader "hexdata"

== Network ==

addnode "node" "command"

clearbanned

disconnectnode ( "address" nodeid )

getaddednodeinfo ( "node" )

getconnectioncount

getnettotals

getnetworkinfo

getnodeaddresses ( count )

getpeerinfo

listbanned

ping

setban "subnet" "command" ( bantime absolute )

setnetworkactive state

== Rawtransactions ==

analyzepsbt "psbt"

combinepsbt ["psbt",...]

combinerawtransaction ["hexstring",...]

converttopsbt "hexstring" ( permitsigdata iswitness )

createpsbt [{"txid":"hex","vout":n,"sequence":n},...] [{"address":amount},{"data":"hex"},...] ( locktime replaceable )

createrawtransaction [{"txid":"hex","vout":n,"sequence":n},...] [{"address":amount},{"data":"hex"},...] ( locktime replaceable )

decodepsbt "psbt"

decoderawtransaction "hexstring" ( iswitness )

decodescript "hexstring"

finalizepsbt "psbt" ( extract )

fundrawtransaction "hexstring" ( options iswitness )

getrawtransaction "txid" ( verbose "blockhash" )

joinpsbts ["psbt",...]

sendrawtransaction "hexstring" ( maxfeerate )

signrawtransactionwithkey "hexstring" ["privatekey",...] ( [{"txid":"hex","vout":n,"scriptPubKey":"hex","redeemScript":"hex","witnessScript":"hex","amount":amount},...] "sighashtype" )

testmempoolaccept ["rawtx",...] ( maxfeerate )

utxoupdatepsbt "psbt" ( ["",{"desc":"str","range":n or [n,n]},...] )

== Util ==

createmultisig nrequired ["key",...] ( "address_type" )

deriveaddresses "descriptor" ( range )

estimatesmartfee conf_target ( "estimate_mode" )

getdescriptorinfo "descriptor"

getindexinfo ( "index_name" )

signmessagewithprivkey "privkey" "message"

validateaddress "address"

verifymessage "address" "signature" "message"

== Wallet ==

abandontransaction "txid"

abortrescan

addmultisigaddress nrequired ["key",...] ( "label" "address_type" )

backupwallet "destination"

bumpfee "txid" ( options )

createwallet "wallet_name" ( disable_private_keys blank "passphrase" avoid_reuse descriptors load_on_startup )

dumpprivkey "address"

dumpwallet "filename"

encryptwallet "passphrase"

getaddressesbylabel "label"

getaddressinfo "address"

getbalance ( "dummy" minconf include_watchonly avoid_reuse )

getbalances

getnewaddress ( "label" "address_type" )

getrawchangeaddress ( "address_type" )

getreceivedbyaddress "address" ( minconf )

getreceivedbylabel "label" ( minconf )

gettransaction "txid" ( include_watchonly verbose )

getunconfirmedbalance

getwalletinfo

importaddress "address" ( "label" rescan p2sh )

importdescriptors "requests"

importmulti "requests" ( "options" )

importprivkey "privkey" ( "label" rescan )

importprunedfunds "rawtransaction" "txoutproof"

importpubkey "pubkey" ( "label" rescan )

importwallet "filename"

keypoolrefill ( newsize )

listaddressgroupings

listlabels ( "purpose" )

listlockunspent

listreceivedbyaddress ( minconf include_empty include_watchonly "address_filter" )

listreceivedbylabel ( minconf include_empty include_watchonly )

listsinceblock ( "blockhash" target_confirmations include_watchonly include_removed )

listtransactions ( "label" count skip include_watchonly )

listunspent ( minconf maxconf ["address",...] include_unsafe query_options )

listwalletdir

listwallets

loadwallet "filename" ( load_on_startup )

lockunspent unlock ( [{"txid":"hex","vout":n},...] )

psbtbumpfee "txid" ( options )

removeprunedfunds "txid"

rescanblockchain ( start_height stop_height )

send [{"address":amount},{"data":"hex"},...] ( conf_target "estimate_mode" fee_rate options )

sendmany "" {"address":amount} ( minconf "comment" ["address",...] replaceable conf_target "estimate_mode" fee_rate verbose )

sendtoaddress "address" amount ( "comment" "comment_to" subtractfeefromamount replaceable conf_target "estimate_mode" avoid_reuse fee_rate verbose )

sethdseed ( newkeypool "seed" )

setlabel "address" "label"

settxfee amount

setwalletflag "flag" ( value )

signmessage "address" "message"

signrawtransactionwithwallet "hexstring" ( [{"txid":"hex","vout":n,"scriptPubKey":"hex","redeemScript":"hex","witnessScript":"hex","amount":amount},...] "sighashtype" )

unloadwallet ( "wallet_name" load_on_startup )

upgradewallet ( version )

walletcreatefundedpsbt ( [{"txid":"hex","vout":n,"sequence":n},...] ) [{"address":amount},{"data":"hex"},...] ( locktime options bip32derivs )

walletlock

walletpassphrase "passphrase" timeout

walletpassphrasechange "oldpassphrase" "newpassphrase"

walletprocesspsbt "psbt" ( sign "sighashtype" bip32derivs )

== Zmq ==

getzmqnotifications

For more specific help use:

bitcoin-cli help <command_name>

For example:

ubuntu@btc:~$ bitcoin-cli help getblockchaininfo

getblockchaininfo

Returns an object containing various state info regarding blockchain processing.

Result:

{ (json object)

"chain" : "str", (string) current network name (main, test, regtest)

"blocks" : n, (numeric) the height of the most-work fully-validated chain. The genesis block has height 0

"headers" : n, (numeric) the current number of headers we have validated

"bestblockhash" : "str", (string) the hash of the currently best block

"difficulty" : n, (numeric) the current difficulty

"mediantime" : n, (numeric) median time for the current best block

"verificationprogress" : n, (numeric) estimate of verification progress [0..1]

"initialblockdownload" : true|false, (boolean) (debug information) estimate of whether this node is in Initial Block Download mode

"chainwork" : "hex", (string) total amount of work in active chain, in hexadecimal

"size_on_disk" : n, (numeric) the estimated size of the block and undo files on disk

"pruned" : true|false, (boolean) if the blocks are subject to pruning

"pruneheight" : n, (numeric) lowest-height complete block stored (only present if pruning is enabled)

"automatic_pruning" : true|false, (boolean) whether automatic pruning is enabled (only present if pruning is enabled)

"prune_target_size" : n, (numeric) the target size used by pruning (only present if automatic pruning is enabled)

"softforks" : { (json object) status of softforks

"xxxx" : { (json object) name of the softfork

"type" : "str", (string) one of "buried", "bip9"

"bip9" : { (json object) status of bip9 softforks (only for "bip9" type)

"status" : "str", (string) one of "defined", "started", "locked_in", "active", "failed"

"bit" : n, (numeric) the bit (0-28) in the block version field used to signal this softfork (only for "started" status)

"start_time" : xxx, (numeric) the minimum median time past of a block at which the bit gains its meaning

"timeout" : xxx, (numeric) the median time past of a block at which the deployment is considered failed if not yet locked in

"since" : n, (numeric) height of the first block to which the status applies

"statistics" : { (json object) numeric statistics about BIP9 signalling for a softfork (only for "started" status)

"period" : n, (numeric) the length in blocks of the BIP9 signalling period

"threshold" : n, (numeric) the number of blocks with the version bit set required to activate the feature

"elapsed" : n, (numeric) the number of blocks elapsed since the beginning of the current period

"count" : n, (numeric) the number of blocks with the version bit set in the current period

"possible" : true|false (boolean) returns false if there are not enough blocks left in this period to pass activation threshold

}

},

"height" : n, (numeric) height of the first block which the rules are or will be enforced (only for "buried" type, or "bip9" type with "active" status)

"active" : true|false (boolean) true if the rules are enforced for the mempool and the next block

},

...

},

"warnings" : "str" (string) any network and blockchain warnings

}

Examples:

> bitcoin-cli getblockchaininfo

> curl --user myusername --data-binary '{"jsonrpc": "1.0", "id": "curltest", "method": "getblockchaininfo", "params": []}' -H 'content-type: text/plain;' http://127.0.0.1:8332/

At the end of command you will see the HTTP api information

The bitcoin-cli getinfo command was removed in 0.16 apparently.

You can however use bitcoin-cli -getinfo

Exploring and decoding transactions#

Use getrawtransaction with the txid

bitcoin-cli getrawtransaction 0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2

A transaction id is not authorisative until a transaction has been confirmed. Only once confirmed in a block is the transaction immuntable and authoritive.

getrawtransaction returns the serialised transaction in hexadecimal to decode it you must input it into decoderawtransaction

{

"txid": "0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2",

"size": 258,

"version": 1,

"locktime": 0,

"vin": [

{

"txid": "7957a35fe64f80d234d76d83a2...8149a41d81de548f0a65a8a999f6f18",

"vout": 0,

"scriptSig": {

"asm":"3045022100884d142d86652a3f47ba4746e”,

“hex":"483045022100884d142d86652a3f47ba4746ec719bbfbd040a570b1de..."

},

"sequence": 4294967295

}

],

"vout": [

{

"value": 0.01500000,

"n": 0,

"scriptPubKey": {

"asm": "OP_DUP OP_HASH160 ab68...5f654e7 OP_EQUALVERIFY OP_CHECKSIG",

"hex": "76a914ab68025513c3dbd2f7b92a94e0581f5d50f654e788ac",

"reqSigs": 1,

"type": "pubkeyhash",

"addresses": [

“1GdK9UzpHBzqzX2A9JFP3Di4weBwqgmoQA"

]

}

},

{

"value": 0.08450000,

"n": 1,

"scriptPubKey": {

"asm": "OP_DUP OP_HASH160 7f9b1a...025a8 OP_EQUALVERIFY OP_CHECKSIG",

"hex": "76a9147f9b1a7fb68d60c536c2fd8aeaa53a8f3cc025a888ac",

"reqSigs": 1,

"type": "pubkeyhash",

"addresses": [

"1Cdid9KFAaatwczBwBttQcwXYCpvK8h7FK"

]

}

}

]

}

This transaction used 1 input - who’s input was a previous transaction.

The output is the 15 millibit and an output back to the sender (the change)

Exploring Blocks#

Blocks can be referenced by block height or block hash.

To get the hash of a specific block height:

bitcoin-cli getblockhash 277316

0000000000000001b6b9a13b095e96db41c4a928b97

Then we can get the block:

bitcoin-cli getblock 0000000000000001b6b9a13b095e96db41c4a928b97

{

"hash": "0000000000000001b6b9a13b095e96db41c4a928b97ef2d944a9b31b2cc7bdc4",

"confirmations": 37371,

"size": 218629,

"height": 277316,

"version": 2,

"merkleroot": "c91c008c26e50763e9f548bb8b2fc323735f73577effbc55502c51eb4cc7cf2e",

"tx": [

"d5ada064c6417ca25c4308bd158c34b77e1c0eca2a73cda16c737e7424afba2f",

"b268b45c59b39d759614757718b9918caf0ba9d97c56f3b91956ff877c503fbe",

"04905ff987ddd4cfe603b03cfb7ca50ee81d89d1f8",

...

],

"time": 1388185914,

"mediantime": 1388183675,

"nonce": 924591752,

"bits": "1903a30c",

"difficulty": 1180923195.258026,

"chainwork": "000000000000000000000000000000000000000000000934695e92aaf53afa1a",

"previousblockhash": "0000000000000002a7bbd25a417c0374cc55261021e8a9ca74442b01284f0569",

"nextblockhash": "000000000000000010236c269dd6ed714dd5db39d3”

}

Accessing functions programmatically#

You can use curl as the api is HTTP:

curl --user myusername --data-binary '{"jsonrpc": "1.0", "id":"curltest", "method": "getinfo", "params": [] }' -H 'content-type: text/plain;' http://127.0.0.1:8332/

So you can use the http client of your choice or a package like bitcoinlib or python bitcon lib

The api is more useful when doing many rpc calls in an automated way

4. Keys and Addresses#

- Cryptography - secret writing

- Digital signature - prove knowledge of a secret without revealing the secret

- digital fingerprint - prive the authenticity of data

Ironically, the communication and transaction data are not encrypted and do not need to be encrypted to protect funds.

Ownership of bitcoin:

- Keys are not stored in the network - they are created and stored by users in a file (wallet)

- The keys are independent of the bitcon protocol - they can be generated and managed without being connected to the internet

- Bitcoin transactions require a valid signature to be included in the block chain - signatures can only be created with a secret key

- Keys come in pairs - a private and public key

- The public key is the bank account number - the secret key is the PIN

- The keys are rarely seen and are managed by the wallet software

- In a transaction the recipients public key is presented by its digital signature - called a bitcoin address.

- A bitcoin address is generated from and corresponds to a public key

- Not all bitcoin addresses represent public keys - they can represent scripts

Bitcoin addresses - abstract the recipient of funds

Public Key Cryptography and Cryptocurrency#

Since the invention of public key cryptography, several suitable mathematical functions, such as prime number exponentiation and elliptic curve multiplication, have been discovered

These mathematical functions are practically irreversible, meaning that they are easy to calculate in one direction and infeasible to calculate in the opposite direction

Bitcoin uses elliptic curve multiplication as the basis for its cryptography

In bitcoin, we use public key cryptography to create a key pair that controls access to bitcoin

- The public key is used to receive funds

- The private key is used to sign transactions and spend funds

The relationship between the private key and public key allows the private key to generate signatures on messages. The signature can be validated against a public key without revealing the private key.

Spending bitcoin:

- public key and signature is presented

- the signature is different every time - but created from the same private key

- Everyone can verify a transaction is valid with just those 2 items

In most wallet implementations, the private and public keys are stored together as a key pair for convenience. However, the public key can be calculated from the private key, so storing only the private key is also possible.

Private and Public Keys#

A bitcoin wallets consists of many key pairs. A private key (k) is a number -> picked at random. From the private key we use elliptical curve multiplication - a one way cryptographic function - to generate a public key (K). From the public key (K) we use a one way cryptographic function to generate a bitcoin address (A)

Asymmetric cryptography - the digital signature can only be created by someone that knows the private key, anyone with access to the public key and transaction fingerprint can verify it.

Private Keys#

The private key is used to spend (and prove ownership) - it must be kept as secret and safe as possible. It must remain secret at all times - giving control to a third party gives them control over that bitcoin.

The private key must remain secret at all times.

The private key must remain secret at all times.

The private key must remain secret at all times.

The private key must be backed up and protected from loss - a loss is a loss forever.

A private key can be picked at random - 256 bit.

Creating a bitcoin is essential pick a number from 1 to 2^256. It is important to have entropy - randomness - to generate a private key.

More precisely a number:

between 1 and (1.158 * 10^77) - 1

So produce a number from putting a string through SHA256 hashing function and ensuring is it less than 1.158 * 10^77

Do not use your own code to generate a random number - use a cryptographically secure pseudo random number generator

The set of private keys is unfathomably large: 2^256 or 10^77

The visible universe is estimated to contain 10^80 atoms

Generating a Private Key#

bitcoin-cli getnewaddress

1J7mdg5rbQyUHENYdx39WVWK7fsLpEoXZy

For security reasons, only the public key is shown.

To expose the private key use:

bitcoin-cli dumpprivkey 1J7mdg5rbQyUHENYdx39WVWK7fsLpEoXZy

KxFC1jmwwCoACiCAWZ3eXa96mBM6tb3TYzGmf6Ywgd

It is not possible for bitcoin to know the private key from the public key - unless it is stored in the wallet.

Public Keys#

Public keys are calculated using irreversible elliptic curve multiplication.

The owner of a private key can generate a public key using elliptical curve cryptography and share it - knowing the private key cannot be acquired from the public key.

It becomes the basis for unforgable secure digital signatures and to prove ownership.

Bitcoin uses a specific elliptic curve: secp256k1

You can check that a coordinate is on the secp256k1 curve if:

>>> (x ** 3 + 7 - y**2) % p = 0

This is the point at infinity

Generating a public key#

The private key k is multiplied by a generator point G results in a public key K

Most bitcoin implementations use openssl’s

EC_POINT_mul()to derive the public key.

Bitcoin Addresses#

A string of digits and characters that can be shared with anyone to send you money.

Addresses are produced from public keys and begin with the digit 1 on the mainnet

eg: 1J7mdg5rbQyUHENYdx39WVWK7fsLpEoXZy

A bitcoin address can represent the owner of a private/public key pair or it can represent a P2SH (Pay to script Hash).

A SHA (Secure Hash Algorithm) and RIPEMD160 are used to make a bitcoin address.

A = RIPEME160(SHA256(K))

Where K is the public key and A is the address

Bitcoin addresses are encoded as Base58Check which uses 58 characters to avoid ambiguity

Encoding#

In order to represent long numbers in a compact way - many computer systems use alphanumeric representations.

- decimal system: 10 numerals

- hexadecimal system: 16 alphanumerics (0 - 10 and A through F)

- Base64 system: 26 lower case, 26 capital, 10 numerals and

+and/

Base64 is commonly used to attach binary to emails

Base58 excludes characters that are frequently mistaken to each other. Base58Check adds 4 bytes at the end to validate

It prevents a mistypes bitcoin address to be accepted by the wallet software.

Base58Check Prefixes#

- Bitcoin address: 1

- P2SH (Pay to script hash): 3

- Bitcoin testnet address: m or n

- Private key WIF: 5, K or L

- BIP-38 encrypted private key: 6P

- BIP-32 extended public key: xpub

Key Formats#

Public keys and private keys can be in various formats.

Private Key Formats#

- Hex: 64 hexadecimals

- WIF: Base58Check prefix of 5

- WIF Compressed: Base58Check prefix K or L

Install bitcoin explorer for a command line tool with many functions including being able to convert between formats

Convert from one format to other:

bx wif-to-ec 5J3mBbAH58CpQ3Y5RNJpUKPE62SQ5tfcvU2JpbnkeyhfsYB1Jcn

1e99423a4ed27608a15a2616a2b0e9e52ced330ac53

You can decode base58check:

bx base58check-decode 5J3mBbAH58CpQ3Y5RNJpUKPE62SQ5tfcvU2Jpbnkeyh

Public Key Formats#

Compressed public keys were introduced to conserve space on nodes (reduce size of transactions). Each public key requires 520 bits. With several hundred transactions per block.

Only the x co-ordinate is needed.

Uncompressed public keys have a prefix of 04

Compressed public keys have a prefix of 02 or 03. 02 if y is even, 03 if y is odd.

(x, y) -> 04 x y -> 02 x (even)

-> 03 x (odd)

Generating an address from the uncompressed public key will be difference from the compressed.

WIF compressed private keys start with a 1 byte suffix 01 - compressed private keys really mean a private key where only compressed public keys should be derived.

Advanced Keys and Addresses#

Encrypted Private Keys#

Private keys must remain secret. However the confidentiality conflicts with the availability.

Keeping a private key private is harder when you need to store backups. There are a lot of variables and methods and ways for things to go wrong.

BIP-38 is an encryption scheme that has the prefix 6P - and requires a password.

The most common case for BIP-38 is for paper wallets - to backup private keys on a piece of paper.

As long as the user selects a strong passphrase, a paper wallet with BIP-38 encrypted private keys is incredibly secure and a great way to create offline bitcoin storage

Go to bitaddress.org and enter wallet details:

private key: 6PRTHL6mWa48xSopbU1cKrVjpKbBZxcLRRCdctLJ3z5yxE87MobKoXdTsJ

passphrase: MyTestPassphrase

It should decrypt to:

5J3mBbAH58CpQ3Y5RNJpUKPE62SQ5tfcvU2JpbnkeyhfsYB1Jcn

P2SH pay to script hash and multisig#

Bitcoin addresses starting with 3 are pay to script hash.

They designate the beneficiary as a hash of a script instead of a public key.

Unlike transactions that send to a 1 public key called P2PKH (Pay to public key hash),

addresses starting with 3 require more than just the single private key proof of ownership.

Multisignature Addresses#

- Common implementation of P2SH

- 2 out 3 signatures are required to spend (sign the spending)

Vanity Addresses#

Eg: 1LoveBPzzD72PUXLzCkYAtGFYmK5vYNR33

The process to get them:

- random private key

- deriving the bitcoin address

- check if it matches a desired vaity pattern

Average search time on a desktop pc for vanity address:

1K- 1 in 58: < 1 ms1Kids- 1 in 11 million: 1 minute1KidsCh- 1 in 38 billion: 2 days1KidsCharity- 1 in 23 quintillion: 2.5 million years

Generating a random address is a bruteforce exercise.

Vanity addresses make it harder for others to fool your customers.

It is better to create a dynamic address per donor instead of a fixed one.

Paper Wallets#

Bitcoin private keys printed on paper. Protection against hard drive failure, theft or accidental deletion.

If they are generated offline they are more secure against threats.

They are just a private key and address printed on a piece of paper.

Put these paper wallets in a fireproof safe and “send” bitcoin to their bitcoin address, to implement a simple yet highly effective “cold storage” solution.

A better way is to use a BIP-38 encrypted paper wallet.

Although you can deposit funds into a paper wallet several times, you should withdraw all funds only once, spending everything. This is because in the process of unlocking and spending funds some wallets might generate a change address if you spend less than the whole amount. Additionally, if the computer you use to sign the transaction is compromised, you risk exposing the private key. By spending the entire balance of a paper wallet only once, you reduce the risk of key compromise. If you need only a small amount, send any remaining funds to a new paper wallet in the same transaction.

5. Wallets#

Wallets describe a few different things in bitcoin.

At a high level a wallet is an application that serves as the primary user interface.

- controls access to money

- manages keys and addresses

- creates and signs transactions

- tracking balance

From a programmer’s perspective wallets are containers for private keys.

Wallet Technology#

User friendly, secure and flexible bitcoin wallets

Wallets do not contain bitcon, they only contain keys. The bitcoin is recorded on the blockchain in the bitcoin network.

Users control the coins by signing transactions in their wallet.

Types of wallets:

- nondeterministic wallets - Each key is independently generated from a random number. Keys are not related to each other. Just a bunch of keys

- deterministic wallets - All keys are derived from a master key - known as a seed. There are many key derivation methods - the most common is the tree-link hierachical deterministic wallet (HD wallet).

Deterministric wallets are initilaised from a seed. Seeds are encoded as english words mnemonic code words

Non deterministic wallets#

The first bitcoin wallet - bitcoin core. Wallets were a collection of randomly generated private keys.

Bitcoin core pregenerated 100 random private keys when first started. More can be generated.

A single key is only used once.

Non deterministic wallets are cumbersome to manage, backup and import.

You need to keep every single key and make backups. If inaccessible all funds are lost forever.

This conflicts with the prinicple of using a bitcoin address only once.

Address reuse reduces privacy.

A type-0 is a poor choice if you want to avoid address reuse. Bitcoin core however comes with a type-0 wallet.

They are doscouraged for anything other than simple tests. They are too cumbersome to manage. A HD wallet with mnemonic seed for backup.

As of bitcoin-core 0.13.0, core uses HD wallets by default.

Deterministic Wallets#

- Have private keys all derived from a single seed

- The most advanced deterministic wallet is the HD (hierachical deterministic) wallet from BIP-32

- Parent child - tree structure

Two major advangages:

- Structure can convey additional meaning - a specific branch for receiving and one for sending payments and another to receive change from transactions

- Users can create a sequence of public keys without having access to the corresponding private keys - so can be used on insecure servers or in a recieve only capacity issuing a different public key for each transaction. Server will never have the private keys.

Seeds and Mnemonic Codes (BIP39)#

Standardised into a sequence of english words easier to transcribe and export. Most wallets now allow for import and export of the seed as mnemonics.

Bitcoin Core contributors don’t consider BIP 39 to be secure

For example:

0C1E24E5917779D297E14D45F14E1A1A

army van defense carry jealous true

garbage claim echo media make crunch

Top is the seed in Hex, below in english mnemonics.

Wallet best practices#

- HD Wallets based on BIP-32

- Multipurpose HD wallet structure based on BIP-43

- Multicurrency and multiaccount based on BIP-44

These standards may remain or become obsolete

Using a Bitcoin Wallet#

Trezor - USD device with 2 buttons. Store keys in the form of a HD wallet. The first use a mnemonic and seed was generated from the built in pseudo random number generator.

A numbered sequence of words - that gabriel wrote down - the backup. The sequence of words is important.

A 12 word mnemonic is used, some wallets use the more secure 24 word mnemonic.

Wallet Technolofy Details#

Mnemonics are often confused with “brain” wallets. A brain wallet consists of words chosen by the user.

More info in the books about:

- Generating mnemonic words

- Generating the mnemonic from seed

A seed can also have a passphrase.

The passphrase protects compromise from a thief, gives a form of plausible deniability or duress wallet (give passphrase to wallet of smaller amounts). If the wallet owner dies the seed is useless and lost forever.

Creating a HD wallet from the seed#

HD wallets are created from a root seed. A 128, 256 or 512 bit random number.

Every key in a HD wallet is deterministically derived from the root seed.

Making it easy to backup, restore, export and import HD wallets containing millions of keys.

The seed is put into a HMAC-SHA512 algorithm to create the master private key and master chain code. Master private key generates the corresponding master public key.

Child key derivation function. Child keys are derived from parent keys - more info on the book on this…

Child private keys are indistinguishable from nondeterministic random keys. You cannot find the parent or siblings or children. You need the child private key and child chain code.

A child private key can therefore be used to make a public key and bitcoin address. Then it can be used to sign transactions and spend from that address.

Extended Keys#

The private key and chain code together is called the extended key. Sharing an extended key gives access to the entire branch.

Extended keys are encoded in Base58Check and start with xprv and xpub

Public child key derivation

Derive public child keys from public parent keys without access to the private key. This is what many online shops and payment providers like btc-pay-server and bitcartCC need in order to generate addresses and invoices for sales and donations.

This shortcut can be used to create very secure public key–only deployments where a server or application has a copy of an extended public key and no private keys whatsoever. That kind of deployment can produce an infinite number of public keys and bitcoin addresses, but cannot spend any of the money sent to those addresses. - perfect for an nline ecommerce store

Uses public key derivation to generate a new bitcoin address

The extended private key is always offline but the extended public key can be used to generate addresses.

It becomes difficult to match orders to transactions using a single bitcoin address.

Note that hardware wallets will never export private keys—those always remain on the device.

Hardened Derivation#

Access to an xpub does not give access to child private keys. However, because the xpub contains the chain code, if a child private key is known, or somehow leaked, it can be used with the chain code to derive all the other child private keys. A single leaked child private key, together with a parent chain code, reveals all the private keys of all the children. Worse, the child private key together with a parent chain code can be used to deduce the parent private key.

To counter this issue some HD wallets use hardened derivation

parent private key is used to derive the child chain code.

Bitcoin core does not support

xpubextended public key - it uses hardened derivation. Check this answer from Pieter Wuille. You cannot export axpubfrom bitcoin-core. This functionality is simply not possible; the keys generated by Bitcoin Core cannot be predicted by an xpub. You can use other wallet software, however.

Note: Bitcoin-core also does not support seed phrases. This is not because bitcoin-core is bare bones and slow. It was decided due to security reasons. Both seedphrases and xpub key derivation make bitcoin less cryptographically secure at the moment.

Index Numbers for normal and hardened derivation#

…more in the book

HD Wallet Key Identifiers#

Keys are identified using a path naming convention. Each level seperated by a /.

Private keys derived from the master private key start with m

Public keys derived from the master public key start with M

The first child is m/0

The second grandchild of the first is /m/0/1

m/0- first child of master private keym/0/0- first grandchild of master private keym/'0/0- The first normal child of the first hardened child of the master private keyM/23/17/0/0- public key

Navigating the HD Wallet structure#

Each parent extended key can have 4 billion children 2 billion harded and 2 billion normal

Each of those can have 4 billion.

That becomes quite hard to navigate.

BIP-43 specified special purpose branches m/i'/

BIP-44 specified using only m/44'/

for m /purpose' / coin_type' / account' / change / address_index

Coin type specified the type or cryptocurrency coin - or rather net? Since there is only 1 - bitcoin.

- Bitcoin mainnet:

m/44'/0' - Bitcion testnet:

m/44'/1'

The third level is for account.

The fourth level has is change - one for creating receiving addresses and 1 for creating change addresses. Uses normal derivation - not hardened - to allow exporting of extended public keys in nonsecured environments.

The fifth level is receiving addresses.

6. Transactions#

Transactions are the most important thing.

Everything else is built to ensure transactions can be created, propagated on the network, validated and added to the global network.

Transactions encode the transfer of value between participants in the bitcon system. Every transaction is recorded in the ledger - the blockchain.

We can get alice’s transaction:

ubuntu@btc:~$ bitcoin-cli getrawtransaction 0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2 true

{

"txid": "0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2",

"hash": "0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2",

"version": 1,

"size": 258,

"vsize": 258,

"weight": 1032,

"locktime": 0,

"vin": [

{

"txid": "7957a35fe64f80d234d76d83a2a8f1a0d8149a41d81de548f0a65a8a999f6f18",

"vout": 0,

"scriptSig": {

"asm": "3045022100884d142d86652a3f47ba4746ec719bbfbd040a570b1deccbb6498c75c4ae24cb02204b9f039ff08df09cbe9f6addac960298cad530a863ea8f53982c09db8f6e3813[ALL] 0484ecc0d46f1918b30928fa0e4ed99f16a0fb4fde0735e7ade8416ab9fe423cc5412336376789d172787ec3457eee41c04f4938de5cc17b4a10fa336a8d752adf",

"hex": "483045022100884d142d86652a3f47ba4746ec719bbfbd040a570b1deccbb6498c75c4ae24cb02204b9f039ff08df09cbe9f6addac960298cad530a863ea8f53982c09db8f6e381301410484ecc0d46f1918b30928fa0e4ed99f16a0fb4fde0735e7ade8416ab9fe423cc5412336376789d172787ec3457eee41c04f4938de5cc17b4a10fa336a8d752adf"

},

"sequence": 4294967295